700% growth in the data center market and a cheaper valuation than peers

We followed up at Tech Week Singapore.

In short, the thesis is that Wasion (3393.HK) is an increasingly discovered company that trades at a discount to peers that is unwarranted, in view of the explosive growth of its subsidiary that is supplying prefabricated data center solutions to Johor and beyond.

Wasion operates three segments:

Power Advanced Metering Infrastructre (AMI) - 43% of rev - Smart power meters that measure electricity consumption. Primary customers are large Chinese electricity companies.

Communication & Fluid AMI - 30% of rev - Like power meters above but measures fluids and gas. Similarly, customers predominantly large Chinese utilities.

The two segments above are the bedrock of the business - Wasion is a leader in China’s domestic market, with solid growth and margins. The C&F AMI segment is operated through a 59.55% subsidiary called Willfar, which is listed in Shanghai. The value of that stake is almost the entire enterprise value of Wasion.

In short, the two segments provide the floor while the last segment dictates the ceiling for the share price:

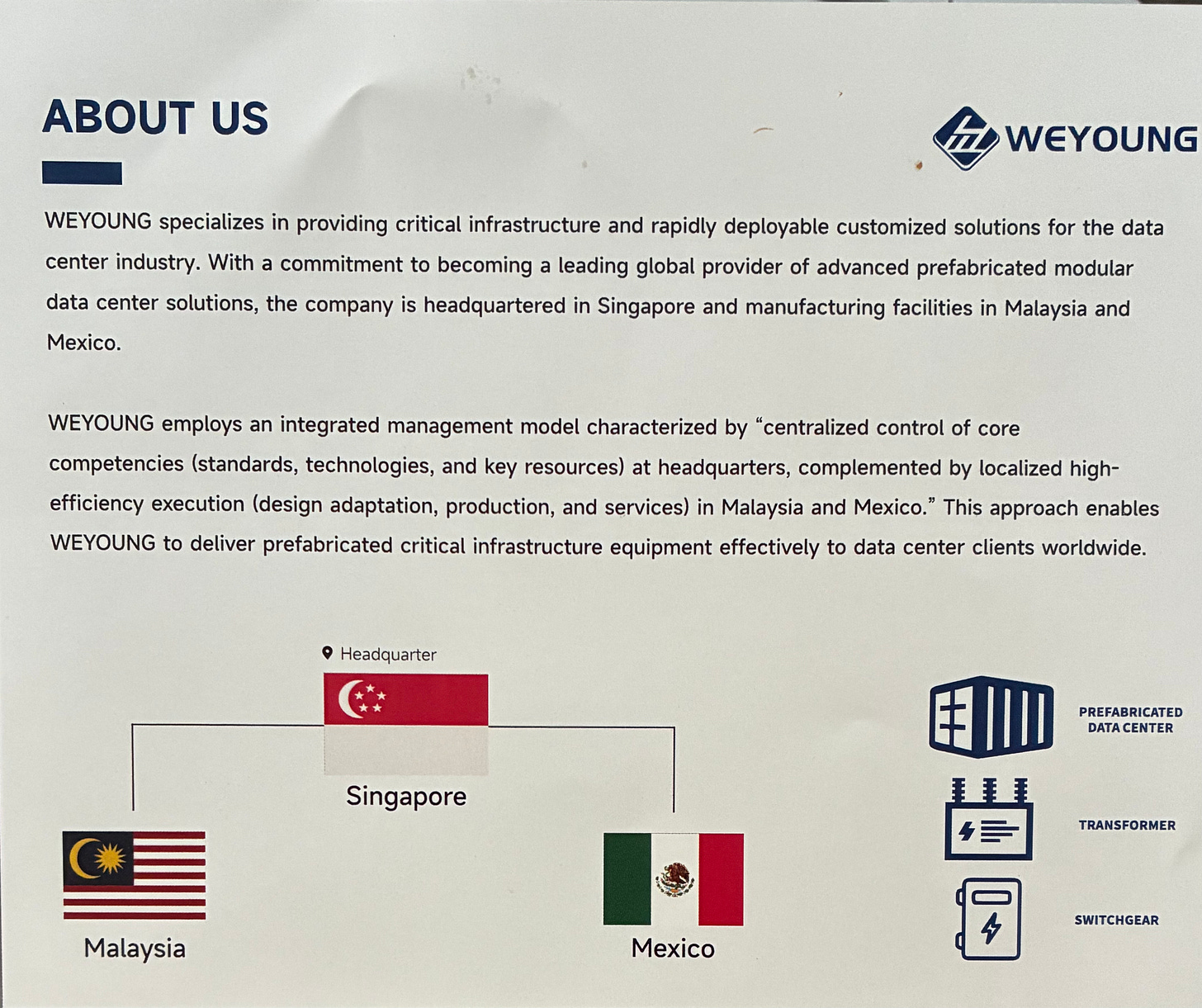

Advanced Distribution Operations - 27% of rev - This is the focus of this note. They have a subsidiary called Weyoung which, in their own words, sells prefabricated equipment to data center clients worldwide, relying on manufacturing facilities in Malaysia and Mexico, see photo of flyer below. Weyoung’s overseas orders have rocketed by 706% year-over-year, from just RMB 59.5 million in H1 2024 to RMB 479 million in H1 2025.

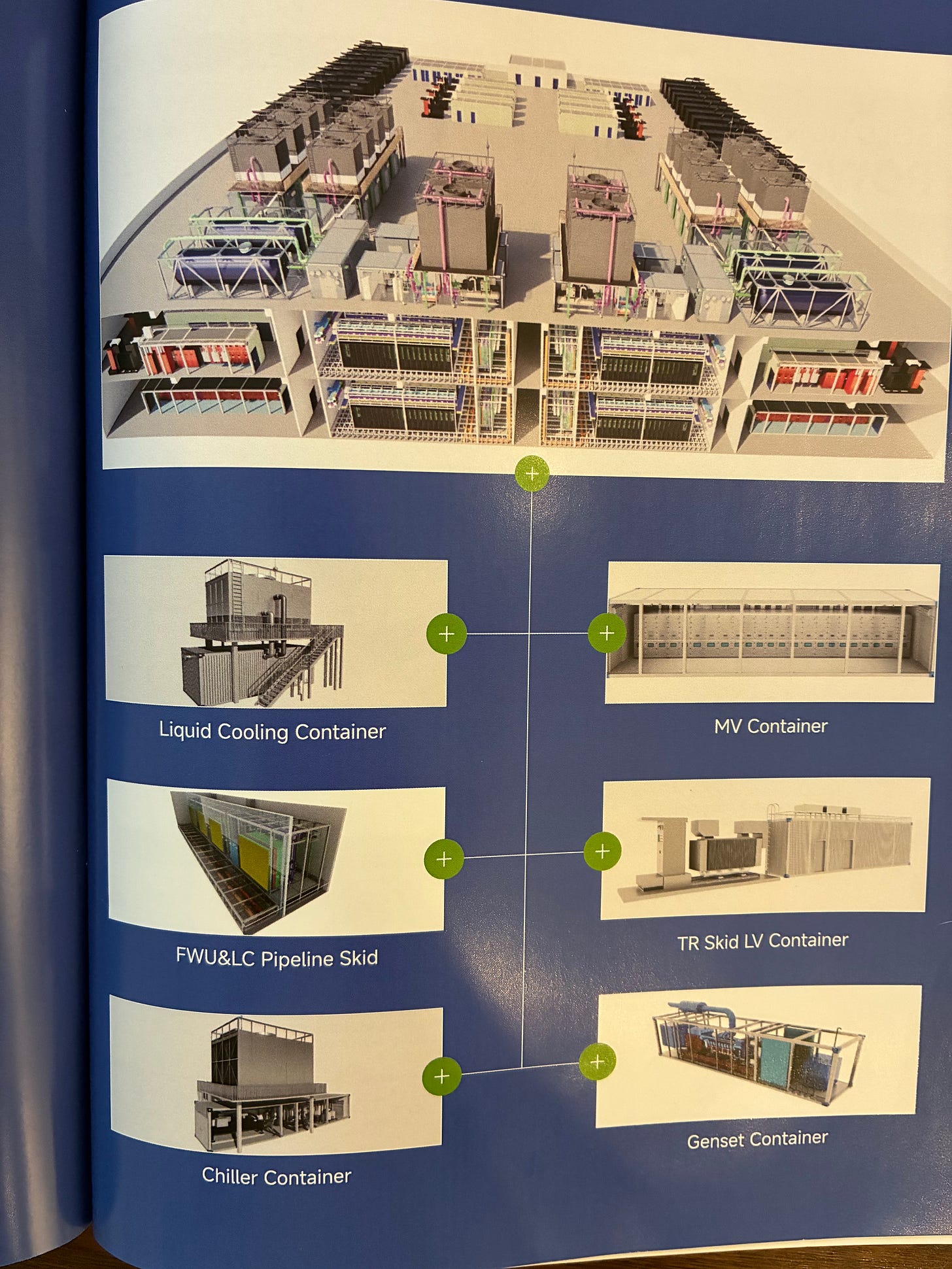

Weyoung’s prefabricated solutions are said to be an advantage in helping developers rapidly stand up their DCs. They assemble, integrate, and test various modules that are essentially plug and play packages, all in parallel with construction, thereby saving time. This is what the modules look like:

Weyoung is going to grow to a much higher % of the company’s revenues. For the reasons discovered during my time at Tech Week Singapore, and explained behind the paywall, Weyoung has the potential to surprise the market in 2025 and 2026.

One of the drivers of this growth is the agreement to support Day One’s aggressive increase in capacity in Johor, Malaysia. Day One’s push is in turn driven by business with ByteDance, Oracle and potentially one other unidentified Western customer. There is further upside in the Mexico facility, which is yet another example of a Chinese company using LatAm to address the global market.

I do not have much to add to the writeups by Mr Ru and Acid Investments, and encourage you to read their notes for more detail.

If you would like to read about my visit to the Weyoung booth at the Tech Week trade show in Singapore, which is the reason for my enthusiasm for this company, as well as my thoughts on the bear case, it is behind the paywall below.

I would like to do more work on this company, particularly the geopolitical risk relating to Bytedance and follow up on the thinking within that organization. Again, if you’d like to follow along, join the 35 paying subscribers in our growing community (that’s almost 15% conversion!)