A look at Singapore's precision engineering sector

And another HK-listed Singaporean company

By reading this, you agree to our terms and conditions.

Dear subscribers,

We are pleased to welcome Iqbal Yusuf as a contributor to this newsletter. Iqbal has written up some excellent picks this year including D-Box Technologies and Pesorama, and has also been quick to pick up on CTR Holdings and Kwan Yong Holdings, among many other winners. We hope that having Iqbal on board will deliver more value to paying subscribers and allow us to cover more markets in due course.

This is a look at Singapore’s precision engineering sector and includes a paywalled writeup of a company on our watchlist. This may be followed by a second writeup of another company subject to further work on the same.

Introduction

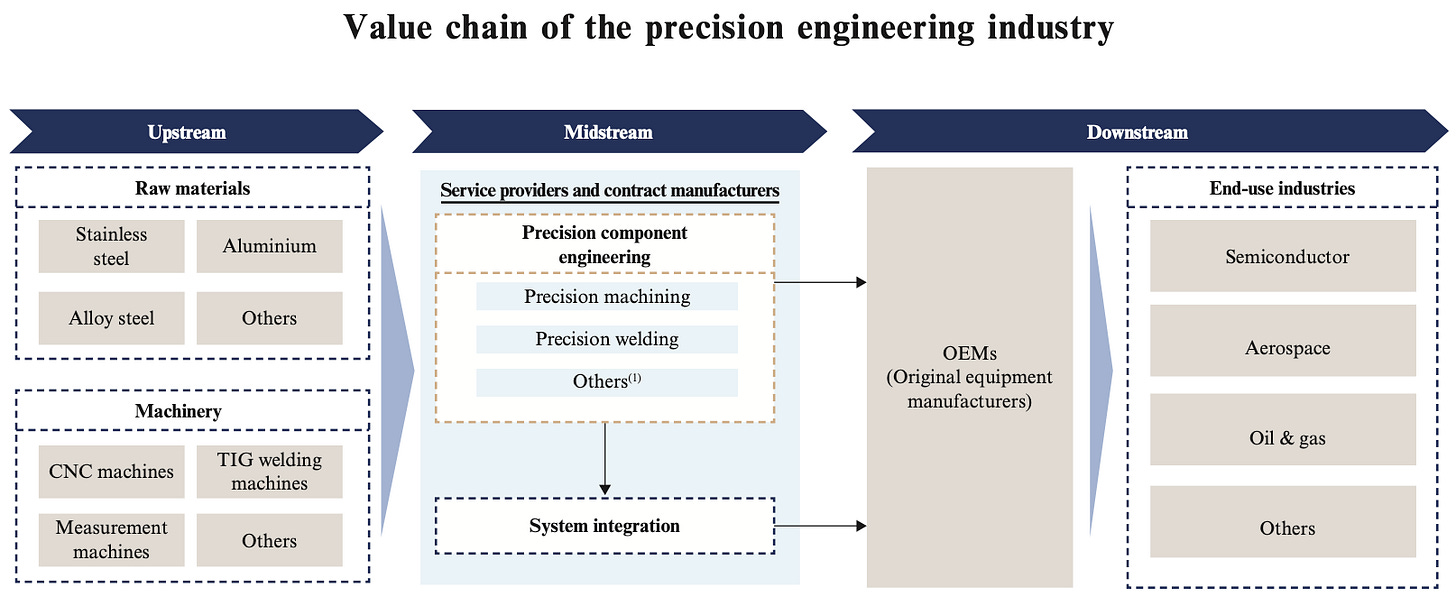

Precision engineering describes the manufacturing of critical, high-tolerance components for industries such as semiconductors and aerospace. The diagram below succinctly explains where precision engineering firms sit in the value chain.

Singapore’s precision engineering SMEs arguably have wonderful opportunities ahead:

Singapore accounts for ~20% of the global production of semiconductor manufacturing equipment.

Singapore’s maintenance, repair and overhaul (MRO) sector services 10% of global aircraft and 19% of global engine maintenance.

As we explain later, both of these sectors require components that are manufactured to exacting standards (or tolerances). Hence the term precision engineering. Suppliers have to pass rigorous qualification processes to embed themselves in a supply chain.

Singapore (and neighboring Johor) are stable, trade-friendly, and geopolitically neutral hubs with strong legal frameworks and intellectual property protection. They are attractive bases for MNCs pursuing a “China+1” strategy of diversifying away from geopolitical hotspots and strengthening supply chain resilience.

Singapore’s Economic Development Board (EDB) attracts and nurtures deep partnerships with MNCs. The EDB reports Fixed Asset Investments (incremental capital investment) and Total Business Expenditure (operating expenditure in Singapore) secured for various industries each year.

On a smaller scale, and creatively, the EDB offers grants to MNCs to defray the cost of partnering with local SMEs and integrating them into the supply chain.

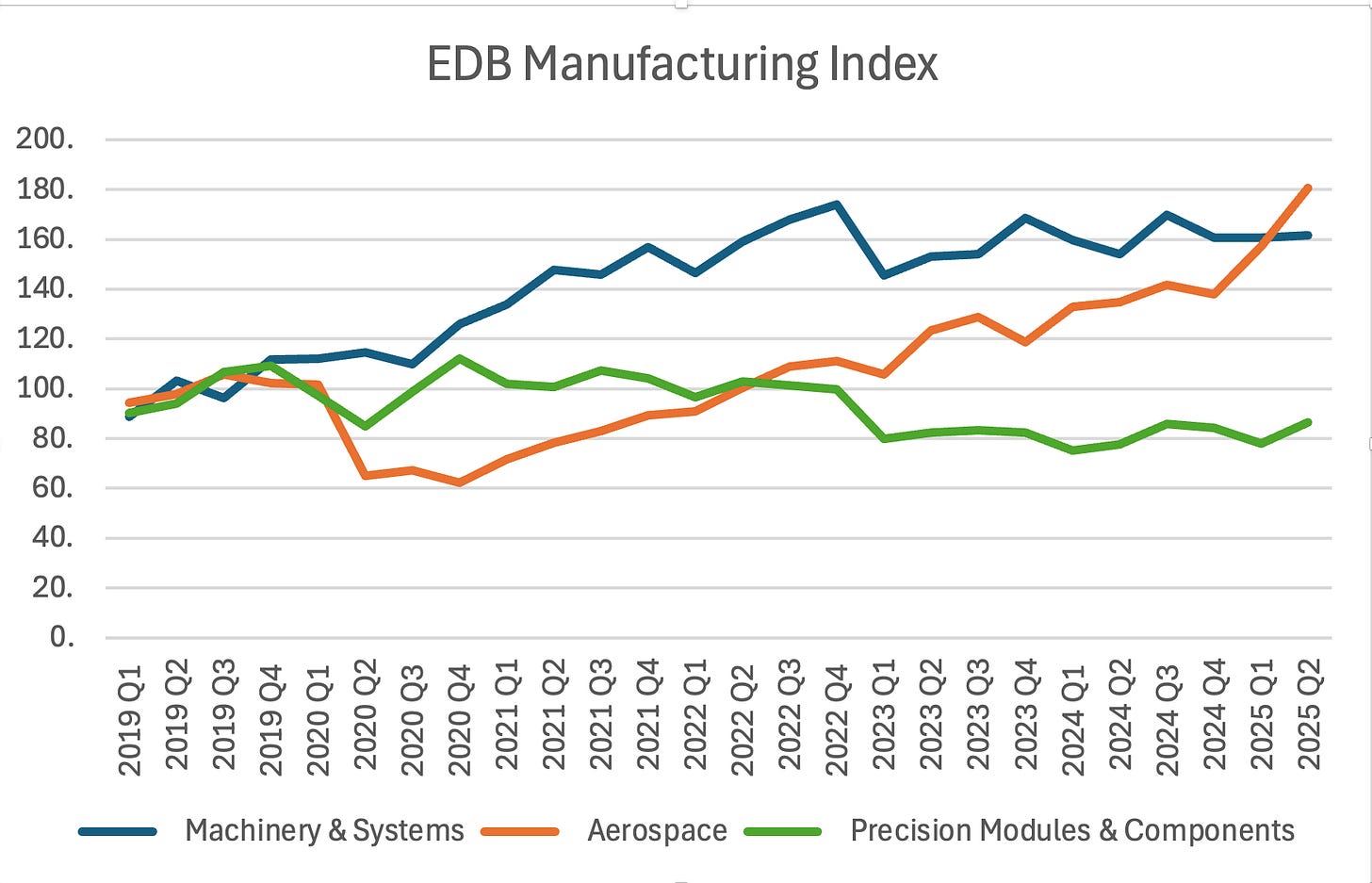

According to the EDB’s manufacturing index:

Aerospace manufacturing has almost doubled since 2022.

Precision modules and components (such as those for semiconductor manufacturing equipment) has been relatively soft albeit showing recent signs of recovery.

Semiconductor equipment is reported in the Machinery & Systems segment, which is showing healthy growth, albeit more choppy and less quick than Aerospace.

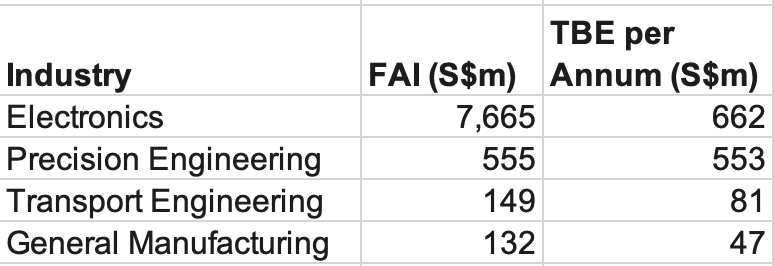

Singapore is responding to the AI capex upcycle with impressive effect. In 2024, the EDB secured Total Business Expenditure per annum of S$ 553 million in the Precision Engineering sector, a 34x increase from the S$ 16 million per annum in 2022. As explained by a contact at the EDB, the TBE is a company’s incremental annual operating expenditure in Singapore, including wages and rental but excluding depreciation. This is a “fixed commitment but typically executed in phases”, which we understand to mean there is some flexibility to ramp up to the committed number. Nonetheless, those are big numbers for SMEs looking for a slice of growth, and does not include numbers that were not committed to the EDB.

By way of contrast, the TBE committed for Transport Engineering as of 2024 was merely S$ 81m, indicating where EDB’s priorities are and which sectors require an extra push.

To explain the diagram below, Precision Engineering refers to semicon equipment and their components. Transport Engineering includes aerospace and marine. Electronics is where semicons themselves are reported. FAI refers to capital investment.

Singapore is reportedly targeting 13% annual growth in the semiconductor precision engineering market through to 2028.

The Ministry of Trade and Industry has called out MRO and precision engineering as bright spots in the quarters ahead. Is the writing on the wall?

[T]he pace of growth in the manufacturing sector is projected to weaken in the coming quarters as the US’ tariff measures weigh on demand in global end-markets. Nevertheless, there remain some bright spots within the sector, namely the transport engineering cluster given the sustained shift towards higher value-added aircraft maintenance, repair & overhaul works in Singapore, as well as the precision engineering cluster due to the continued ramp-up in capital investments by semiconductor manufacturers producing AI-related semiconductors.

Ministry of Trade and Industry Economic Survey of Singapore Q2 2025

On that note, we turn to Metasurface Technologies Holdings Limited (“Metasurface”). Listed on HKEX GEM on 2 Jul 2024 at HK$ 2.42 per share, it’s hitting the AI capex upcycle with a clean balance sheet, a two-decade track record, and the support of the second largest supplier of semiconductor equipment in the world, Applied Materials.