A look at Singapore's precision engineering sector

And another HK-listed Singaporean company

By reading this, you agree to our terms and conditions.

Dear subscribers,

We are pleased to welcome Iqbal Yusuf as a contributor to this newsletter. Iqbal has written up some excellent picks this year including D-Box Technologies and Pesorama, and has also been quick to pick up on CTR Holdings and Kwan Yong Holdings, among many other winners. We hope that having Iqbal on board will deliver more value to paying subscribers and allow us to cover more markets in due course.

This is a look at Singapore’s precision engineering sector and includes a paywalled writeup of a company on our watchlist. This may be followed by a second writeup of another company subject to further work on the same.

Introduction

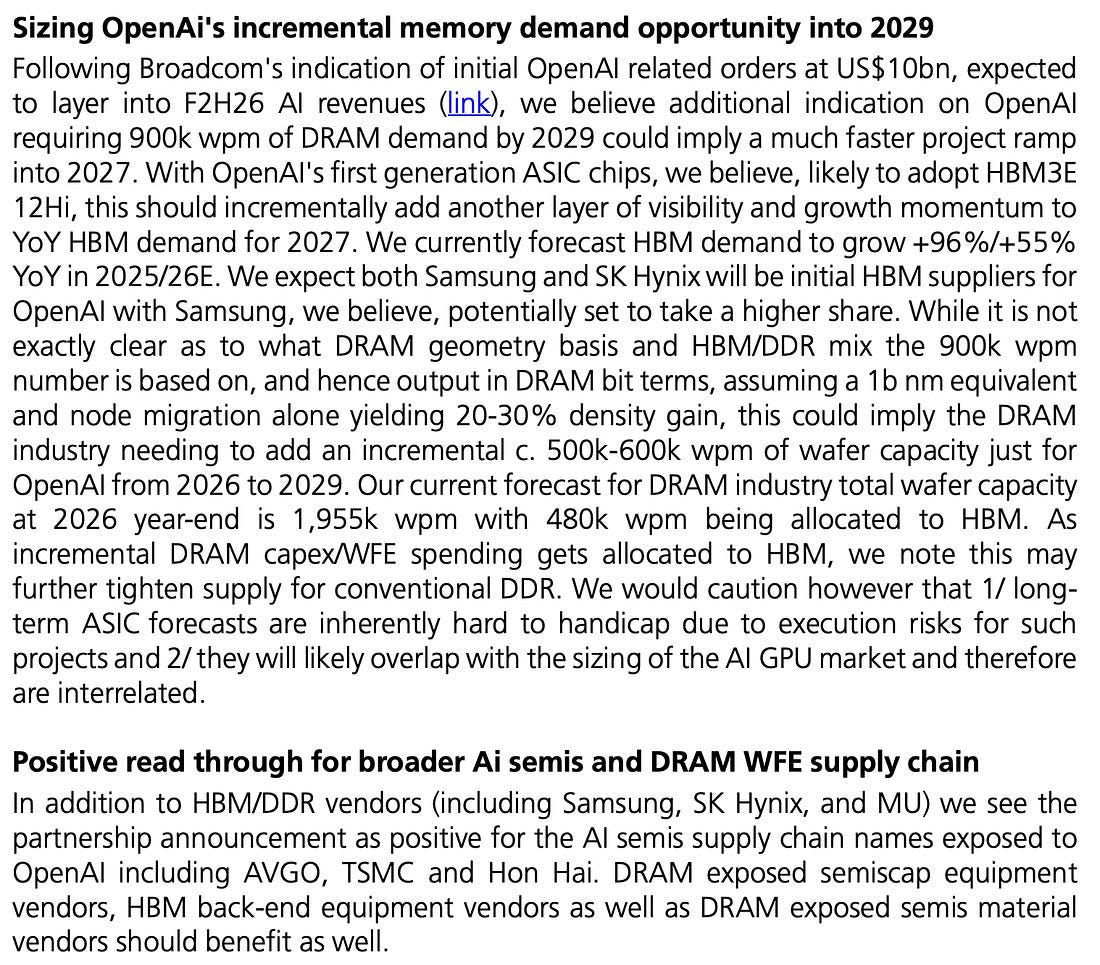

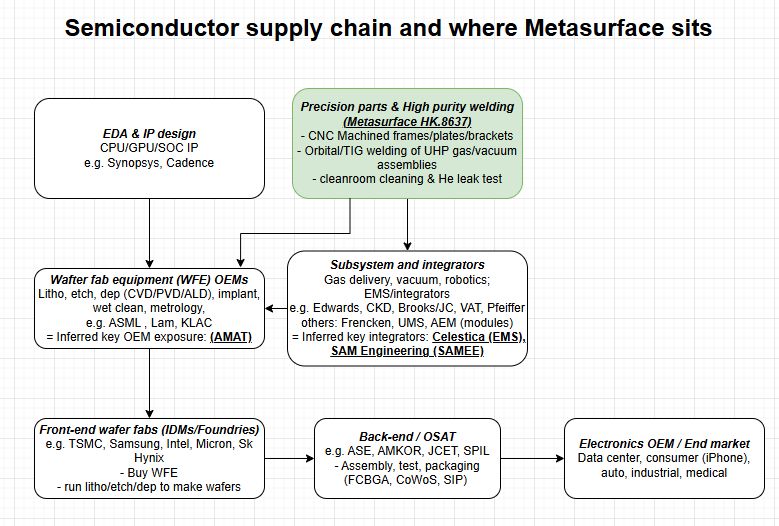

Precision engineering describes the manufacturing of critical, high-tolerance components for industries such as semiconductors and aerospace. The diagram below succinctly explains where precision engineering firms sit in the value chain.

Singapore’s precision engineering SMEs arguably have wonderful opportunities ahead:

Singapore accounts for ~20% of the global production of semiconductor manufacturing equipment.

Singapore’s maintenance, repair and overhaul (MRO) sector services 10% of global aircraft and 19% of global engine maintenance.

As we explain later, both of these sectors require components that are manufactured to exacting standards (or tolerances). Hence the term precision engineering. Suppliers have to pass rigorous qualification processes to embed themselves in a supply chain.

Singapore (and neighboring Johor) are stable, trade-friendly, and geopolitically neutral hubs with strong legal frameworks and intellectual property protection. They are attractive bases for MNCs pursuing a “China+1” strategy of diversifying away from geopolitical hotspots and strengthening supply chain resilience.

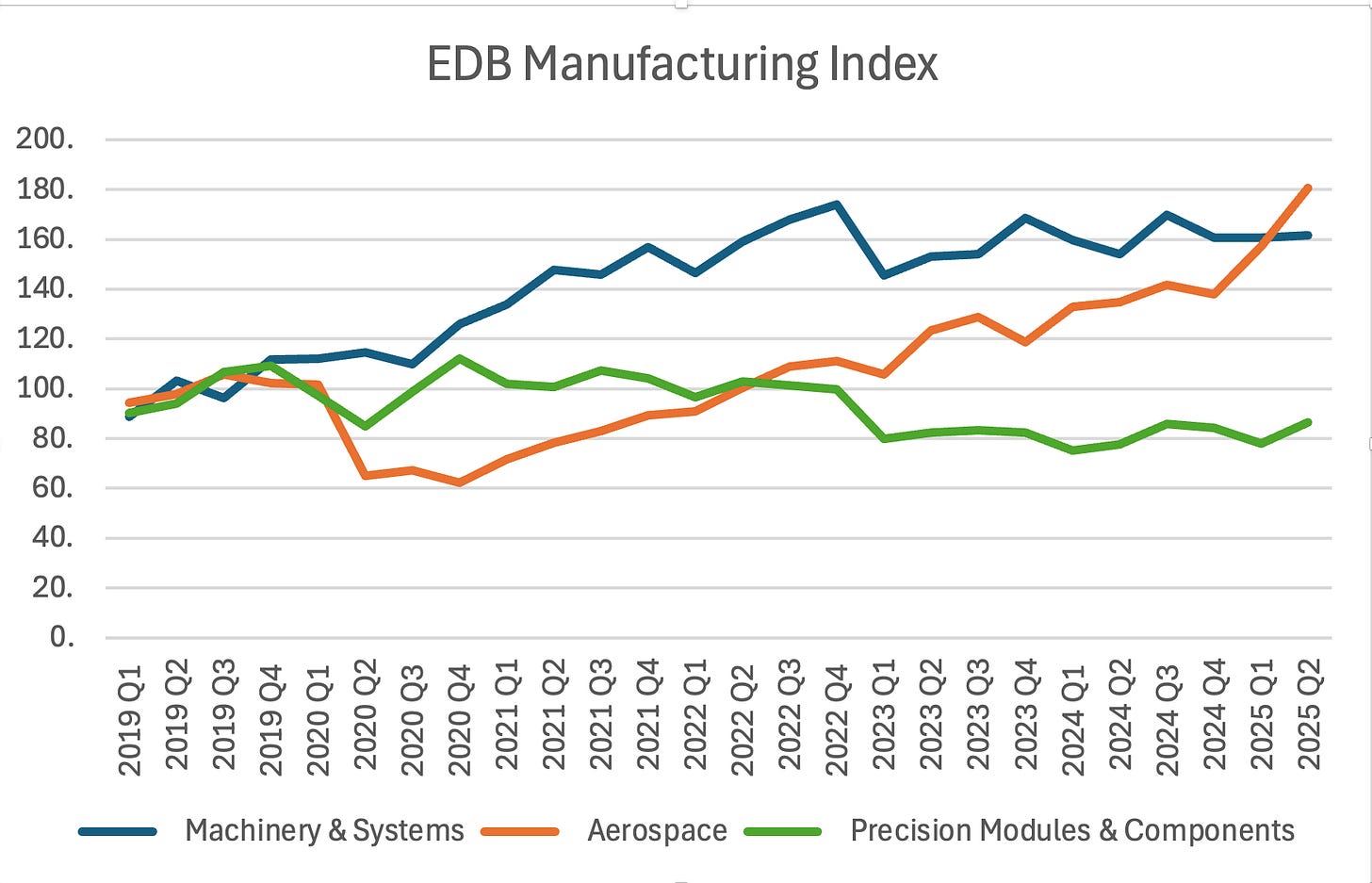

Singapore’s Economic Development Board (EDB) attracts and nurtures deep partnerships with MNCs. The EDB reports Fixed Asset Investments (incremental capital investment) and Total Business Expenditure (operating expenditure in Singapore) secured for various industries each year.

On a smaller scale, and creatively, the EDB offers grants to MNCs to defray the cost of partnering with local SMEs and integrating them into the supply chain.

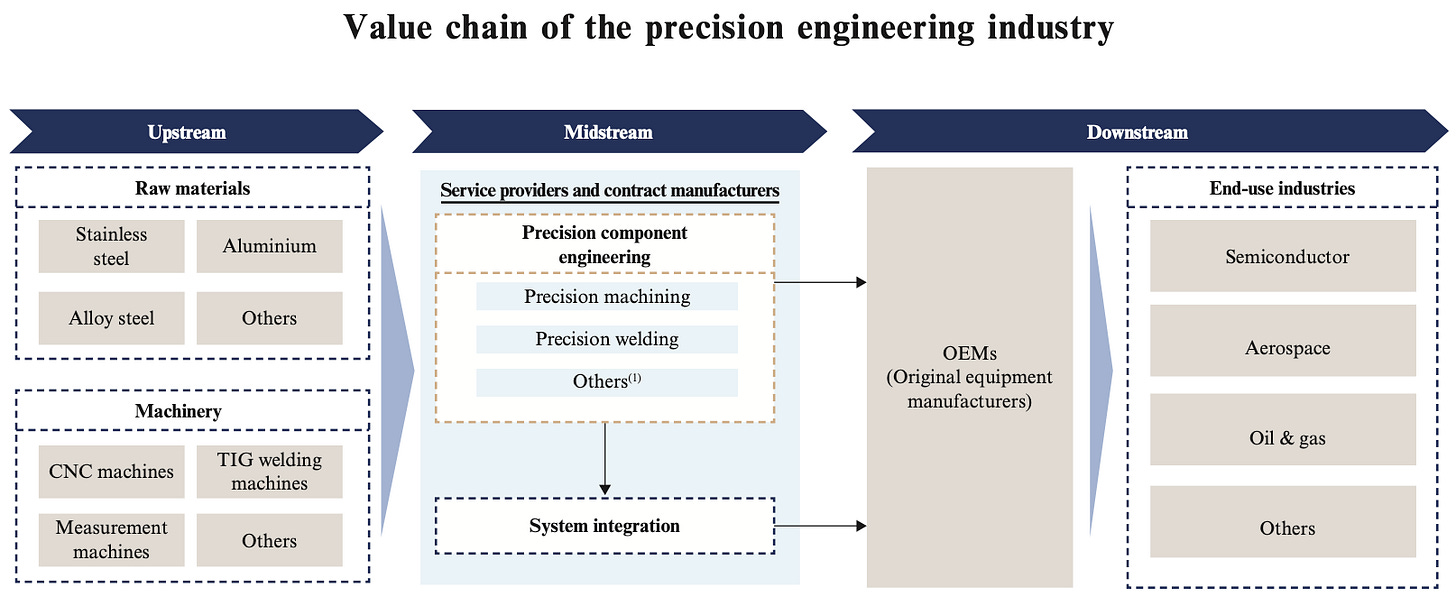

According to the EDB’s manufacturing index:

Aerospace manufacturing has almost doubled since 2022.

Precision modules and components (such as those for semiconductor manufacturing equipment) has been relatively soft albeit showing recent signs of recovery.

Semiconductor equipment is reported in the Machinery & Systems segment, which is showing healthy growth, albeit more choppy and less quick than Aerospace.

Singapore is responding to the AI capex upcycle with impressive effect. In 2024, the EDB secured Total Business Expenditure per annum of S$ 553 million in the Precision Engineering sector, a 34x increase from the S$ 16 million per annum in 2022. As explained by a contact at the EDB, the TBE is a company’s incremental annual operating expenditure in Singapore, including wages and rental but excluding depreciation. This is a “fixed commitment but typically executed in phases”, which we understand to mean there is some flexibility to ramp up to the committed number. Nonetheless, those are big numbers for SMEs looking for a slice of growth, and does not include numbers that were not committed to the EDB.

By way of contrast, the TBE committed for Transport Engineering as of 2024 was merely S$ 81m, indicating where EDB’s priorities are and which sectors require an extra push.

To explain the diagram below, Precision Engineering refers to semicon equipment and their components. Transport Engineering includes aerospace and marine. Electronics is where semicons themselves are reported. FAI refers to capital investment.

Singapore is reportedly targeting 13% annual growth in the semiconductor precision engineering market through to 2028.

The Ministry of Trade and Industry has called out MRO and precision engineering as bright spots in the quarters ahead. Is the writing on the wall?

[T]he pace of growth in the manufacturing sector is projected to weaken in the coming quarters as the US’ tariff measures weigh on demand in global end-markets. Nevertheless, there remain some bright spots within the sector, namely the transport engineering cluster given the sustained shift towards higher value-added aircraft maintenance, repair & overhaul works in Singapore, as well as the precision engineering cluster due to the continued ramp-up in capital investments by semiconductor manufacturers producing AI-related semiconductors.

Ministry of Trade and Industry Economic Survey of Singapore Q2 2025

On that note, we turn to Metasurface Technologies Holdings Limited (“Metasurface”). Listed on HKEX GEM on 2 Jul 2024 at HK$ 2.42 per share, it’s hitting the AI capex upcycle with a clean balance sheet, a two-decade track record, and the support of the second largest supplier of semiconductor equipment in the world, Applied Materials.

Founded in 2000, Metasurface (HKEX:8637) is a Singapore-headquartered precision engineering firm, specializing in high-precision machining and welding solutions. It provides critical component fabrication for semiconductor and aerospace OEMs.

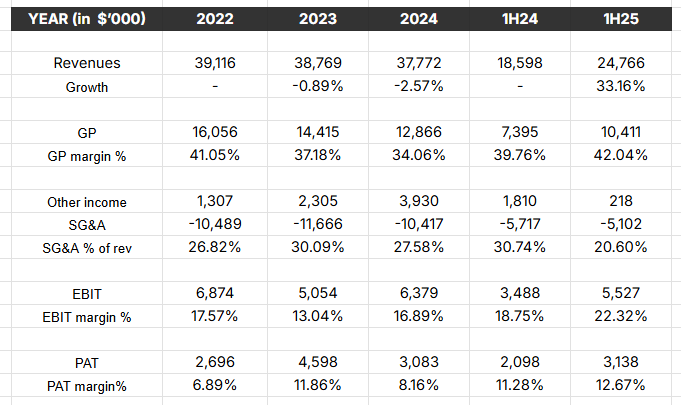

First-half FY25 sales rose 33% year over year to S$ 24.7m, and they had about S$17.8m of confirmed orders as of June 2025.

Metasurface has 150 million shares outstanding with a relatively tight ownership structure. The founder/CEO Dato’ Sri Chua and his family remain controlling shareholders, holding ~53.12% of shares as of mid-2025.

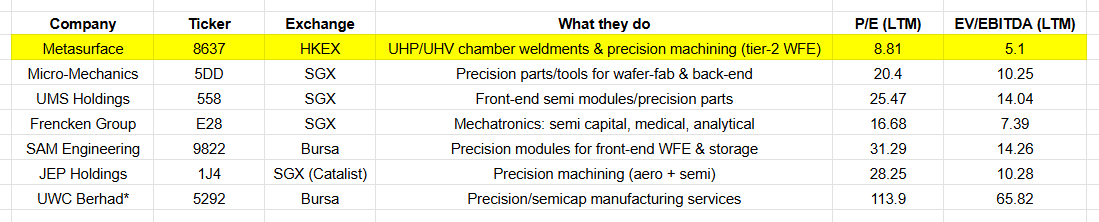

At ~HK$1.45–1.50, Metasurface trades at single-digit to low-double-digit LTM P/E and ~5× EV/EBITDA (incl. leases). That is a discount to Singapore/Malaysia precision peers that command mid-teens to low-20s multiples.

Metasurface has significant exposure to a single semiconductor customer - Applied Materials - and its contract manufacturers / service providers. On the other hand, it has a sound balance sheet and is a qualified supplier entering the right part of the cycle. Further, our conversations with various reps were encouraging:

In response to questions about continued momentum in H2 2025, the company would only say that the “semiconductor industry is ramping up” and that they were “in the same bandwagon”.

They are in early discussions with other OEMs that they have done business with before, and that announcements in 2026 were possible.

While there is increased utilization of equipment for aerospace parts, they are still in the process of getting qualified with some aerospace customers, and anticipate that this is a 2027 story. Interestingly, UOB felt confident enough to predict in its initiation of coverage that aerospace would grow from 8% of the business in 2024 to almost 20% in 2027. Such diversification might justify a higher multiple.

As an added bonus, you get Metasurface’s 12.9% stake in MetaOptics, a metalens technology startup that has a partnership with Singapore’s Agency for Science, Technology and Research.

We now turn this over to Iqbal for more detail below.

Metasurface derives ~90% of its revenue from semiconductor-related customers (S$33.7M of S$37.7M in 2024). This heavy exposure means its fortunes track the semiconductor capital expenditure cycle.

After a softer 2023, the global semiconductor industry saw a robust rebound in 2024, with ~19% sales growth to a record ~$627 billion. Industry forecasts predict 2025 could set another record (~$697B chip sales) amid secular drivers like AI, 5G, and IoT. This bodes well for semiconductor equipment demand.

As a precision parts supplier for semiconductor equipment and processes, Metasurface benefits directly from this upswing. Moreover, geopolitics (e.g. U.S. CHIPS Act, EU Chip programs, regional fabs in SG/MY) is driving new fab construction and tooling demand, expanding the TAM for suppliers like Metasurface.

Aerospace & Other Industries: Although smaller (~8% of 2024 revenue), aerospace segment revenues nearly doubled from S$1.65M to S$3.03M in 2024. The post-pandemic recovery in aviation (record aircraft order backlogs, demand for new fuel-efficient models) means aerospace suppliers are scaling up production. As mentioned earlier, we understand the company is in the midst of qualification processes in pursuit of growing this business.

Additionally, the company addresses markets in data storage, solar, and oil & gas industries. While data storage revenue declined in 2024 (S$0.8M vs S$2.4M in 2023) amid a weak HDD/consumer electronics cycle, any rebound in enterprise storage or new drive technologies (e.g. HAMR drives requiring precision tooling) could revive this segment.

What does Metasurface manufacture for Applied Materials?

Based on its IPO prospectus, Metasurface’s relationship with AMAT dates back to at least 2009.

Singapore represents a cornerstone of AMAT’s global footprint. Since establishing its regional headquarters there in 1991, the Singapore Operations Center has grown to become the company’s largest manufacturing factory outside of the United States. AMAT’s presence in Singapore also includes advanced R&D centers, sales and service operations, and field support offices. The scale of this operation and its deep integration into the local ecosystem were recognized in 2019 when AMAT received the Distinguished Partner in Progress Award from the Singapore Economic Development Board.

Launched in 2022, AMAT’s Singapore 2030 plan has three main objectives. First, the primary goal is strengthening manufacturing capacity. This drive for increased output necessitates suppliers who can reliably deliver high volumes of components and sub-assemblies, integrate seamlessly into complex logistics, and maintain impeccable quality standards to support scaled production.

The other relevant objective is broadening technology ecosystem partnerships. AMAT has explicitly signalled its intention of deepening relationships with local suppliers, aligning itself with the government’s plans.

All of this has culminated in Metasurface’s 18 December 2024 announcement of a new “collaboration” with AMAT to supply wafer fabrication vacuum chambers and ancillary parts. That announcement sparked little reaction from the market, which continued to send shares down to HK$ 0.6.

We believe we will be seeing the fruits of this closer relationship in 2025 and beyond, as AMAT has expressly signaled increasing production volumes year over year for the next three years.

So what does Metasurface supply to AMAT?

We understand that AMAT’s Endura platform is/was assembled in Singapore - it was “ideated, designed and developed in Singapore”. UMS Integration, a local company, manufactured up to 70% of the wafer transfer modules for the platform (one of the most sensitive components), and also assembled it in Singapore for many years.

However, we think that Metasurface’s PR alludes to the Producer platform when it refers to supplying “newly designed” components “integral to the OEM’s new ultra-high productivity platform for sub-180 nm devices”.

We believe that the Producer platform is the only platform that meets the description of “ultra-high productivity” because of its Twin Chamber architecture, enabling the processing of up to six wafers simultaneously. Ultra-high productivity is also the exact language used in AMAT’s own PR about the platform.

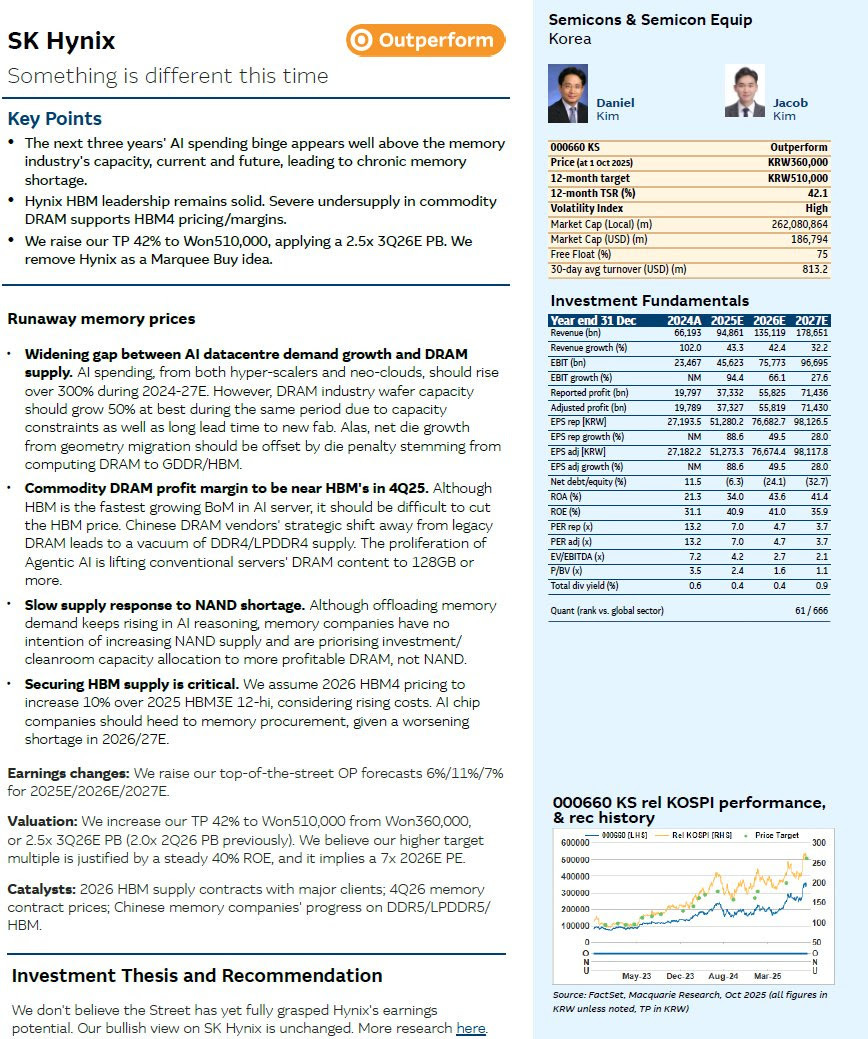

Assuming that is correct, we have a high degree of confidence that Micron, Samsung and SK Hynix will be placing large orders for this versatile industry workhorse, driving Metasurface’s revenues for the duration of the memory CapEx boom.

We also observe that the vacuum parts supplied by Metasurface are not the most sensitive parts of the platform in terms of tolerance and that they should fall within the +/-10µm capability advertised in Metasurface’s prospectus. Anything that has more direct interaction with the wafer is likely to be a more demanding component, which Metasurface might graduate to producing in the future, an opportunity to capture a larger part of the value chain.

Optionality - MetaOptics

A unique aspect of Metasurface’s opportunity is its 12.9% stake in MetaOptics Limited, a Singapore-based metalens technology startup.

Metalenses are ultra-thin optical components seen as next-generation solutions for augmented reality (AR), 3D sensing (LiDAR), medical imaging, and consumer devices. MetaOptics recently became the first pure-play metalens company to go public, listing on SGX Catalist in Sep 2025.

The listing raised capital to accelerate R&D and scale production of its proprietary “flat lens” platform, which targets AR glasses, smartphone sensors, autonomous vehicle LiDAR, etc.

For Metasurface, this is a strategic foothold in a potentially high-growth field: AR/VR and sensing applications are projected to grow rapidly this decade, and metalenses could enable lighter, cheaper optical systems. MetaOptics has reported early design wins and purchase orders in these markets.

The successful IPO of MetaOptics in Sept 2025 already boosted the value of Metasurface’s stake. At S$0.44, Metaoptics has a MC of S$105M. Metasurface’s stake is (to overly simplify) valued at S$ 13.5m or roughly 1/3 of its own MC.

There are further potential catalysts related to this investment:

MetaOptics Performance: If MetaOptics secures major partnerships, its share price could rise further. MetaOptics is also aiming to pioneer meta-optics in AR/VR devices; any news of design wins in consumer electronics (e.g. inclusion of its metalens in a smartphone or AR glasses) could send its stock soaring. Metasurface’s stake would appreciate accordingly, increasing its NAV.

Financial Windfall: Metasurface could choose to monetize part of this stake if the price is right. Selling a portion of shares in MetaOptics could realize a cash gain. That cash could be redeployed into core operations or returned to shareholders. Even if they hold, accounting rules may eventually require marking the investment to market, possibly boosting reported earnings through an unrealized gain.

Collaboration Synergy: A softer catalyst is the potential commercial synergy – e.g., MetaOptics might outsource certain high-precision fabrication tasks to Metasurface (molds for metalens production, custom test jigs, etc.). This would directly translate into revenue for Metasurface and deepen its involvement in the burgeoning AR hardware field. While not guaranteed, the PR from Metasurface calls MetaOptics an “associate” and speaks of strengthening alliance and future collaboration hinting this could materialize.

Financials

FY 2022–2024 revenue was essentially flat. Weakness in certain lines was offset by broader end-market diversification. In 1H25, revenue increased ~33% YoY on broad semiconductor-supply-chain demand. With an order book of only ~S$17.8m at 30 Jun 2025, we model 2H25 as flat to slightly softer versus 2H24.

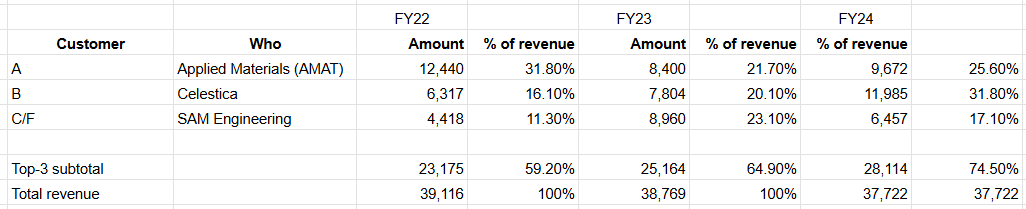

Sales are concentrated in the top three customers, which the company does not name (reported as Customers A, B and C/F). Based on the descriptors in the filings (business profile, scale, fiscal year, and geography), we believe customer A is Applied Materials, customer B is Celestica, and while customer C/F is SAM Engineering

Post IPO, the company has cash 15.6m with total debt of 2.5m.

The next AI CapEx boom

We believe the DRAM/HBM upcycle is in its early innings and should translate into higher front-end WFE orders (e.g., for Applied Materials). In Q1–Q2 FY25, DRAM accounted for ~27–28% of AMAT’s revenue, and management guided to >40% growth from advanced DRAM in 2025. AMAT’s DRAM customer base is led by Samsung (12% of FY24 revenue), with SK Hynix and Micron also meaningful albeit at <10% of revenues each.

Despite a prolonged downturn in commodity memory since 2022, the emergence of AI inference constitutes a distinct demand vector, projected to expand 5–6× within two years amid insufficient capacity additions.

To simplify, we believe Metasurface will indirectly benefits from the upcoming memory cycles once their customer ramps up capex.

AI inference demand ↑ → DRAM/HBM capacity adds & node migrations.

That drives more etch/CVD/ALD vacuum modules at WFE OEMs (e.g., AMAT).

OEMs either build in-house or outsource modules to integrators (e.g., Celestica/SAM).

Metasurface supplies UHP weldments/chambers/gas panels into those modules.

DRAM/HBM cycle → AMAT orders → Celestica integrator→ Metasurface parts.

Risks

Customer concentration. In FY24, top 3 customers made up almost ~74% of Metasurface revenue.

Cycle risk: 89-90% of Metasurface revenue is from the semiconductor industry. A semiconductor downturn will impact Metasurface’s financials.

Quality issues damaging relationships. We draw some comfort from the company’s long track record and 15 year relationship with Applied Materials. They also have aerospace relationships, which have some of the most stringent qualification standards.

Catalysts

Semiconductor Capex Cycle Rebound

Aerospace & Other Sector Growth

Earnings Beats / Improved Guidance

Transfer to main board

Dividend Initiation

MetaOptics Value Unlock

Current Valuation

At ~HK$1.45, the stock equates to a ~HK$224–240m market cap (150m shares), or roughly 9–12× LTM P/E.

Comparable Singapore/Malaysia precision names typically trade in the mid-teens to low-20s P/E range at this point in the cycle. On an EV/EBITDA basis, whether measured ex- or incl. IFRS-16 leases Metasurface still screens inexpensive versus peers.

Valuation

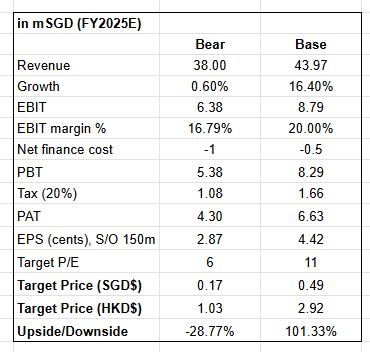

For the bear case, we assume FY25 revenue and EBIT margin are unchanged from FY24. For the base case, we assume 16.4% FY25 revenue growth, 20% ebit margin, and a re-rating to 11x P/E (a discount to peers trading around 16–20x+).

This implies ~100% upside with ~28% downside, arguably an attractive asymmetric setup.

This appraisal excludes any potential value unlock from the MetaOptics stake.

Conclusion

Metasurface may offer an attractive asymmetric opportunity. They are cash-rich company in a cyclical upturn, trading at a reasonable valuation. With prudent management and multiple growth catalysts (from industry trends and government support to unique tech investments), it has the potential to appreciate significantly.

This idea seems to share some similar characteristics to Global Testing? Another name Iqbal wrote about

Interesting article, thank you for your work. Unfortunately, I can't invest in this company from IBKR Spain, but I am invested in Soon Lian Holding, which, from what I've read here, also has a tailwind.