A misunderstood REIT spin-off in Singapore

Centurion Corporation is looking a little unloved at the moment.

This has to be a short, quickly written post as Centurion’s REIT subscription deadline is today.

Centurion Corporation is Singapore’s largest “Purpose-Built Worker Accomodation” provider. Roughly 25% of its business is student housing but that is not the focus of this note, which aims to add perspective to the misinformed chatter about its upcoming REIT spin-off and foreign worker accommodation in Singapore.

Following some of the milestones in the REIT listing process, Centurion shares popped, reaching a high of around S$1.85. I understand heavy selling volume sent this back down to as low as S$1.61.

I decided to investigate this dynamic and formed a few hypotheses. This is not financial advice or valuation work, merely anecdotal evidence sprinkled with some observations about demand and supply of accommodation that outline the bull case.

Retails investors believe that the REIT is purchasing assets from Centurion for a discount.

I understood that most retail investors receiving a 200 page shareholder circular on the REIT transaction would pause to wonder whether the REIT or Centurion would be a better investment, and suspected that many would prefer to own the REIT, which more directly owns the real estate in question.

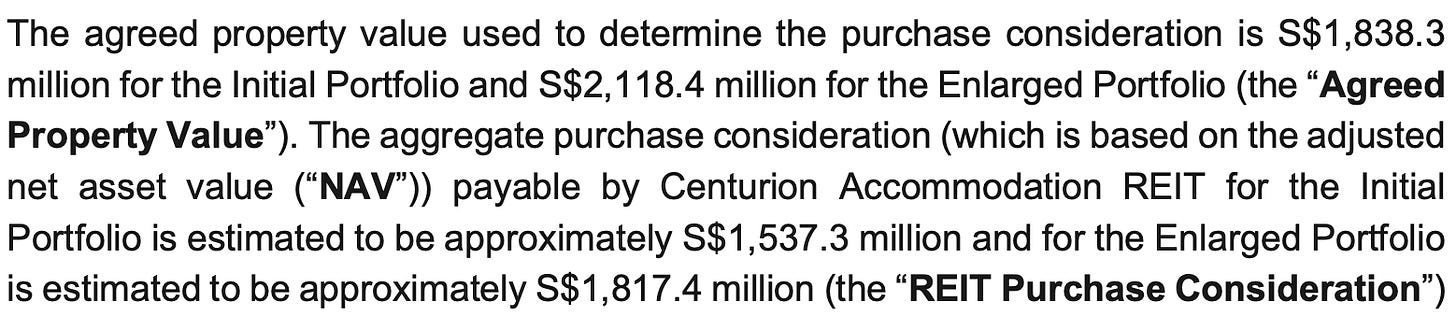

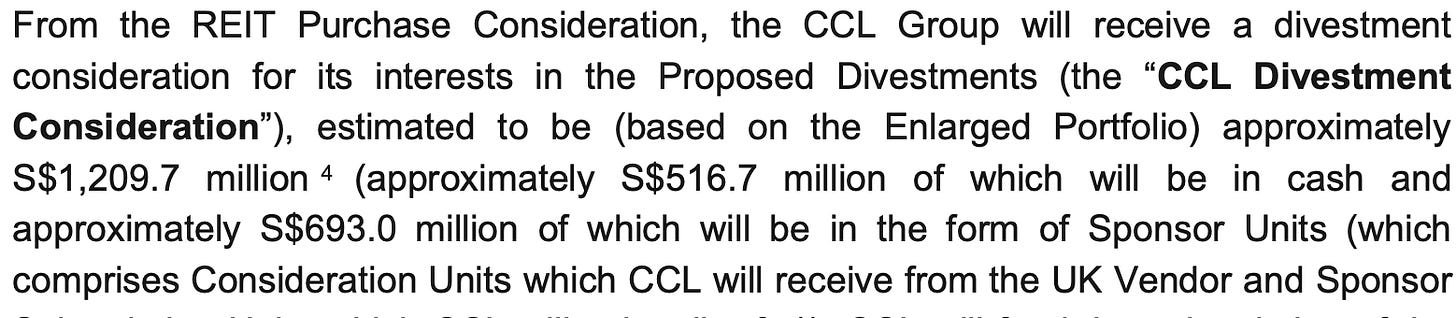

What I did not expect was that some people believe that Centurion is transferring assets to the REIT for below market value. This is because the shareholder circular states that the purchase consideration is around S$ 300 million lower than the agreed property value:

Worse, the divestment consideration is optically even lower:

Feeding this into ChatGPT or DeepSeek (what I expect most investors use) yields some entertaining and incorrect results. With the right prompt I’m sure you can get a good explanation of why the above concern is misplaced. FWIW, the divestment consideration works out to ~$1.43 a share.

Surely the market cap did not materially drop over this? An amusing idea for sure.

Retail investors are selling Centurion to purchase the REIT

Just speculation on my part. However, given that there is only around S$ 11 million in allocation for retail investors, one wonders what is going to happen if investors find they are under allocated. Will they return to the parent or bid the REIT up, bringing its yield down from the projected 7-8%?

We shall find out soon as the REIT subscription closes today.

In the event the REIT is bid up, don’t fret - Centurion aims to declare a dividend in specie of REIT units after its 2026 AGM, bringing its ownership of the REIT from 45% to 35% to 40%. This is a 6-7% in specie yield.

Popular finance bloggers are publishing without an adequate understanding of Singapore, the construction industry, and the drivers of accommodation demand and supply.

I cannot profess to be an expert on Singapore construction but it is relatively trivial to observe that when taking on board online opinions about an investment, one should be mindful of the lens through which that opinion is formed.

Many investors will approach Centurion like any other real estate business, and I do not fault them for doing so. However, having dug into Singapore construction for several weeks, I see them differently - as the largest dorm provider in the country they are a key partner to the Singapore government in managing a very tricky issue - Singapore’s unfortunate reliance on a cheap (second class?) labour force to power its economic growth.

Why is Centurion an important part of Singapore policy? Let’s look at demand and supply.

I believe foreign worker demand and numbers is a sensitive political issue and you will not see projections explicitly reported. Instead you have to look at indicators and oblique references to the demand.

The government has relaxed restrictions - removing maximum employment periods, raising maximum age limits and expanding the list of countries foreign workers can be hired from. This is pitched as giving employers flexibility and not because there is, as construction bosses more colourfully put it, “construction bursting out of our ears”. I believe the muted way this is discussed in the mainstream leads to foreign worker projections that are too light, particularly among widely read bloggers who have no background in construction. Even “experts” get this wrong, initially predicting a 5-8% increase in rent this year due to moderating demand (??), only to see increases over 10% so far this year.

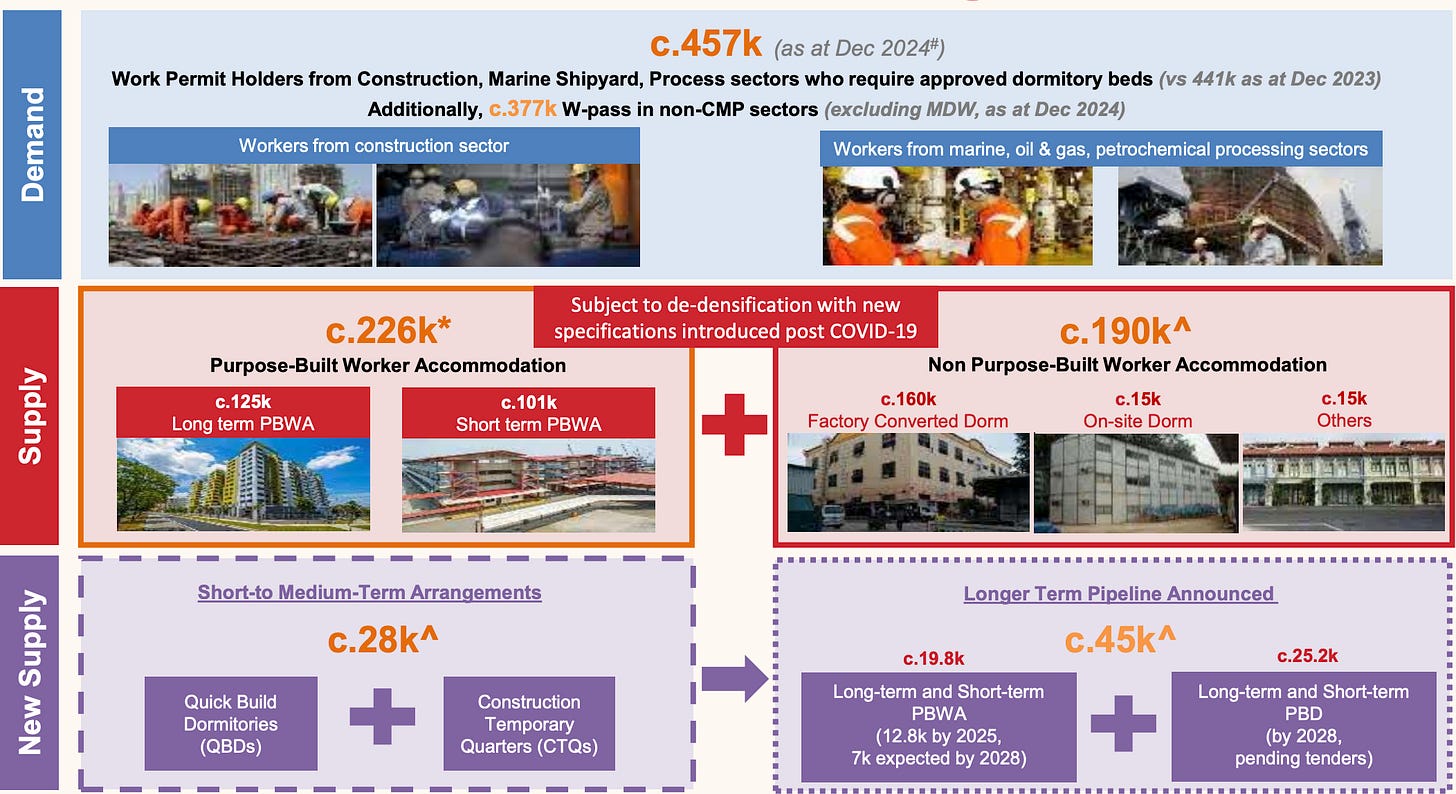

On the flip side, supply is also misunderstood. In short, while there are more purpose built dormitories coming online, that growth does not account for the beds coming off the market as dormitories are refurbished to meet new dorm standards (something to cheer!). Nor does it account for the fact that the big shortfall in accommodation supply is currently being plugged by a variety of short term measures that I believe will gradually be phased out. This slide from Centurion is key:

The dorm market is not close to saturation. I believe the long term goal is to house almost all foreign workers in purpose-built worker accommodation, requiring up to a doubling of existing capacity (190k in “non purpose built worker accommodation”) and 28k in short to medium term arrangements).

The overall goal of the government might be to exert control over migrant workers, and the easiest way to do that is to house everyone in (to put it simplistically) one place. The hypothesis is that the Ministry of Manpower will achieve this by gradually tightening licenses on non purpose built worker accommodation.

They are even building their own dorms, though the Minister has clearly stated they have no interest in competing with Centurion and are doing this to set the standard of dorm quality, incidentally something which would support further rent increases.

Finally, you won’t see new entrants just pop up building more dorms - a combination of zoning, regulations and close dialogue with all stakeholders (including the construction cos) ensures very good visibility on the future dorm supply.

How should a business like this, essential to the construction underway in the next five years and growing under the careful watch of the Singapore government, be valued? I would think it is currently being undervalued by Singaporean investors.

More reading:

Analyst targets are north of S$2 now

If you enjoyed reading this, can I encourage you to donate to one of the many charities devoted to protecting migrant workers in Singapore such as Transient Workers Count Too or Its Raining Raincoats. Working and living conditions remain difficult and are arguably improving at too slow a pace. Every investor in this sector has to grapple with that. A post for another time I think.

Pictured: Migrant workers working on a public housing project.

Disclaimer: Centurion is a core holding. This is not a recommendation to buy or sell stocks. These are my personal notes from research derived from sources that I believe to be reliable. There is no representation as to the accuracy or completeness of the research. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in here are my own and are subject to change without notice.