AI demand ≠ everyone is a winner

Summary of the weekend's AI discussion

Dear readers,

After Friday’s sell-off, there was a healthy amount of reflection and debate in several chat groups we are in, which we summarise below.

Enterprise Adoption

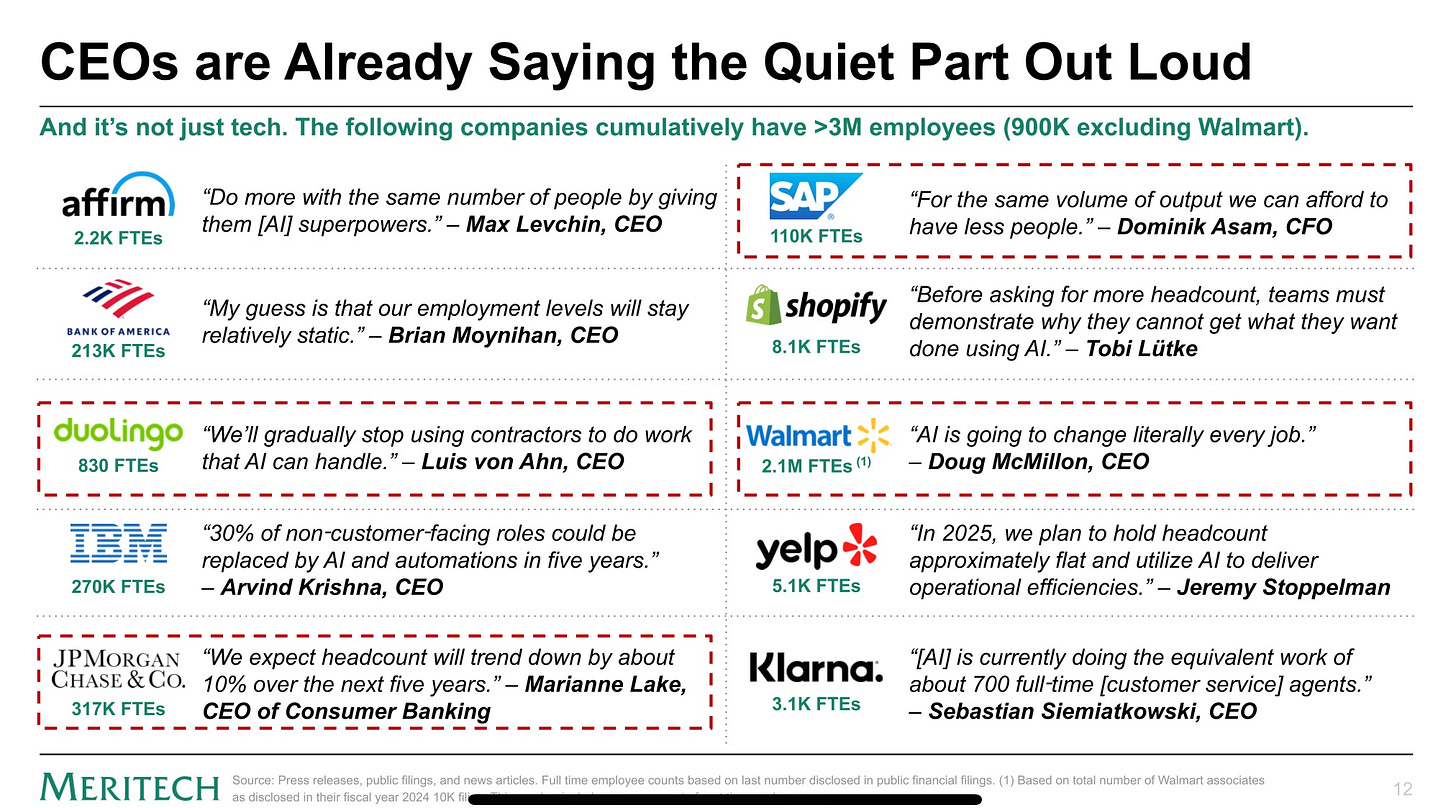

Whatever your views on the current utility of AI for work, CEOs are publicly committing to deploy AI. They will spend to roll it out, utilisation is a different question. The dynamic is explained in this funny satirical thread.

This is also translating into softer hiring:

Some observed that the current state of AI is already useable in customer service and HR screening interviews (anecdotes of LLMs being able to assess the fit of candidates).

If you’d like to read more summaries of the 2026 enterprise adoption debate, we will be posting them in the subscriber chat. This was a big point of discussion over the weekend.

The price you pay matters

Investors are currently being pitched a wide array of names with an AI sticker on them. We see this everyday in the Twitter thread listing various beneficiaries, particularly in Optics.

Many of these names are trading at premium valuations despite much higher execution risk, and exposure to margin compression and cyclicality.

AI demand does not translate into durable margins for everyone involved.

There is a very narrow list of companies have the structural drivers (software lock-in, manufacturing monopolies, proprietary connectivity) to maintain durable margins over time. The play is not to buy everything with an AI sticker on it.

To some extent you can surmise the market’s view on that list by looking at what sold off the most on Friday.

What did the closed chat groups think was on the list of winners and losers?

Nvidia and TSM were the obvious answers, trading at relatively low 2027 EPS numbers. Broadcom also listed as a winner, although I personally have reservations.

Japan was named as a good place to fish. Semiconductor choke points sit overwhelmingly in Japan: photoresists, wafer-grade silicon, high-purity gases, etching chemicals, precision robotics, and metrology systems. Japan controls the majority of several of these upstream inputs.

So, which names in particular?