APAC Roundup: 14 January 2026

Union Tool, AT&S and other bottlenecks, Metasurface coming home, Citrini on Malaysia, ASML

Union Tool +6.2%, new 52-week high

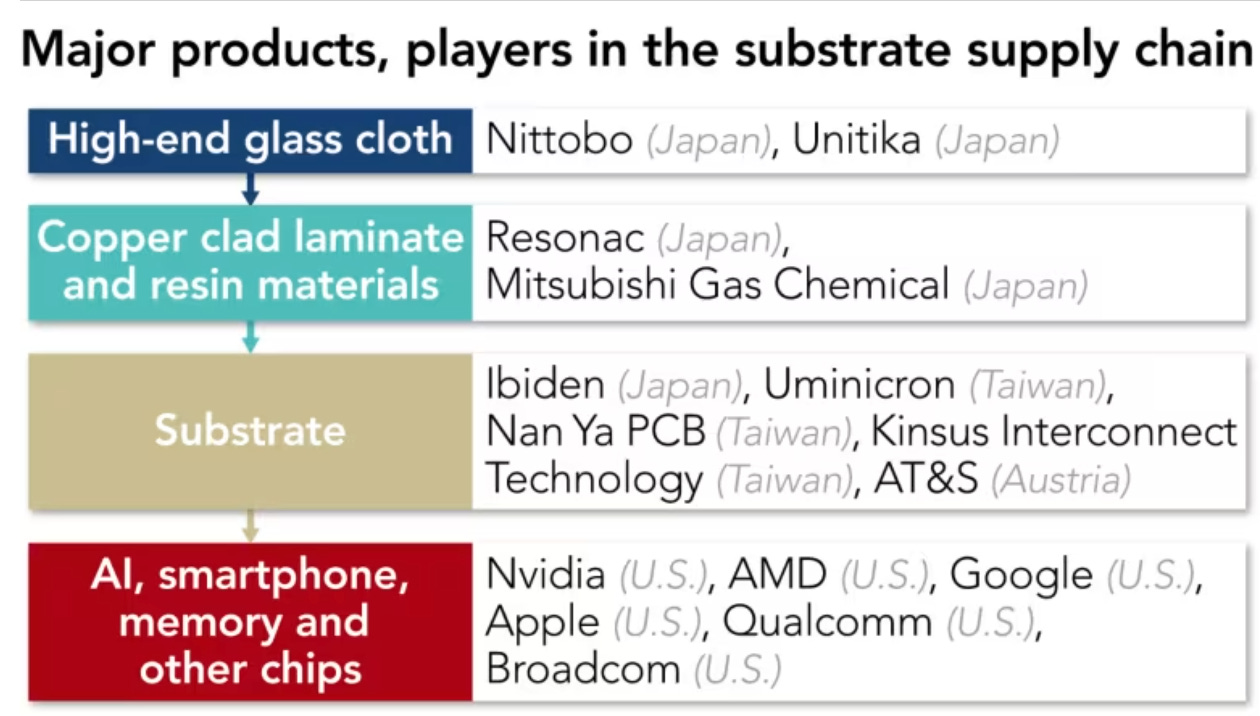

A few bottlenecks identified in this piece principally about Nittobo. Nikkei Asia:

Many other components and materials related to chip substrates and printed circuit boards also face potential shortages this year, executives in the chip and electronics industries say.

One example that multiple industry insiders pointed to is drill bits and drilling machines, used to drill layers of printed circuit boards for servers. In the past, one drill bit could be used many times, but AI server boards have become thicker, harder and more expensive, which means drill bits must be much more advanced and replaced more frequently.

China’s Guangdong Dtech Technology, Shenzhen Jinzhou Precision Technology and Taiwan’s Topoint are the biggest drill suppliers by capacity, but smaller Japanese players Union Tool and Kyocera have the highest quality, one source said.

AT&S gets a call out too:

Other names:

Taiyo Ink, for instance, holds a dominant share in the market for solder resist, a coating used on every PCB to prevent short circuits, low manufacturing yield and reliability failures. Laser drilling machines by Mitsubishi Electric and Via Mechanics are considered almost the only options for companies needing advanced laser drilling capabilities, sources told Nikkei Asia.

Our other favourite here Towa Corp +10.3% likely a response to SK Hynix new plant?

Metasurface Technologies

Halted today before they announced that they are considering a dual listing in Singapore!

…the Company is considering to apply for a listing (the “Proposed Listing”) of its shares (the “Shares”) on the Catalist Board of the Singapore Exchange Securities Trading Limited (the “SGX-ST”) with the intention to be dual primary-listed on the Stock Exchange and SGX-ST, subject to fulfillment of requirements and/or conditions of the SGX-ST and the applicable laws, rules and regulations. As at the date of this announcement, the Company has engaged professional advisers to advise on the Proposed Listing and no formal listing application has been made.

Hopefully this encourages our other Singaporean HKSE orphans to come home.

Spotlight on Malaysia

Citrini out with a memo bullish on SE Asia (ex Thailand and Singapore). In particular, they like Malaysia:

Three points to add to that:

As one reader observed, if you’re long SE Asia, perhaps you should also be long a SE Asian bank listed in Singapore, like UOB.

Ramping in ASEAN isn’t always smooth sailing. We’d like to do more keeping investors in the likes of Coherent and AT&S updated on SE Asia operations. See TTMI’s comments at Needham yesterday about their difficulties in Penang: