APAC Roundup: 16 February 2026

Union Tool, Mitsui Kinzoku, Seikoh Giken, and Applied's results

Folks,

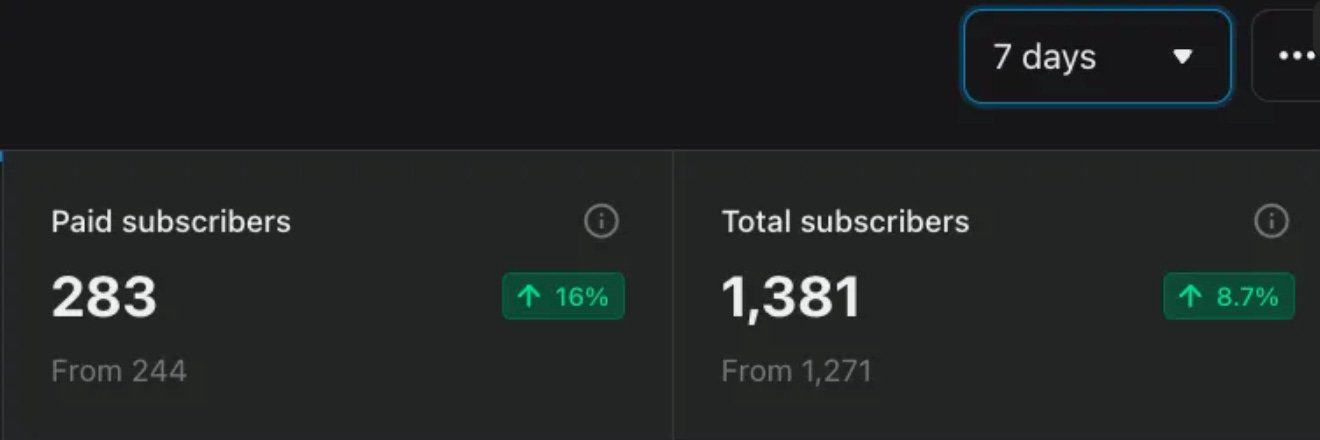

We added 39 paid subscribers this week after writing about our best ideas in Singapore and Japan. Paid conversion remains high at 20%.

If you are new here, I am doing this full time, with incredible support from Iqbal Yusuf. We treat each of our 1,381 readers as stakeholders and try to earn ourselves one true fan a day.

Six months in, we are on track to match the ARR trajectory of Stratechery, as disclosed by Ben Thompson in this podcast.

We also have our first multi-bagger in the shape of Seikoh Giken.

I learned about Seikoh Giken shortly after turning attention from Singapore to Japan in October 2025. The stock was close to an all time high then, but the beauty of exponential growth is that you can probably catch the story mid-train and still double your money.

Our favourite Japanese companies are exponential growth stories. You can read about our latest pick here:

Today’s update is a look at some results last week:

Union Tool

Mitsui Kinzoku

Seikoh Giken (Adding to this position!)

Applied Material’s comments on supply chain, relevant to our favourite idea in Singapore:

We are working on some ideas outside Singapore and Japan, so keep an eye out for that.

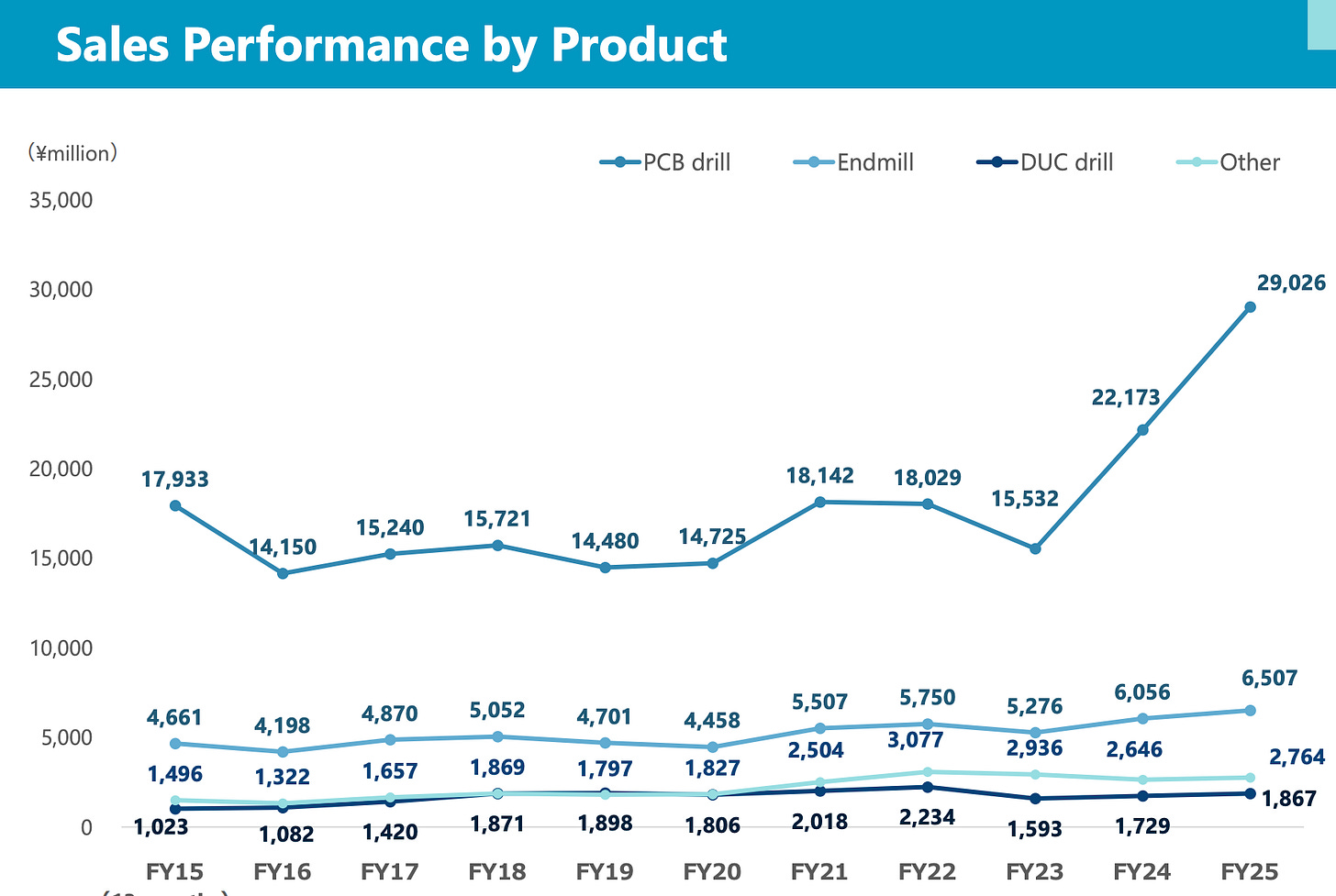

Union Tool (TSE: 6278)

Released results on Thursday and sold off 10% on a weak Friday morning in Japan. That dip was quickly bought.

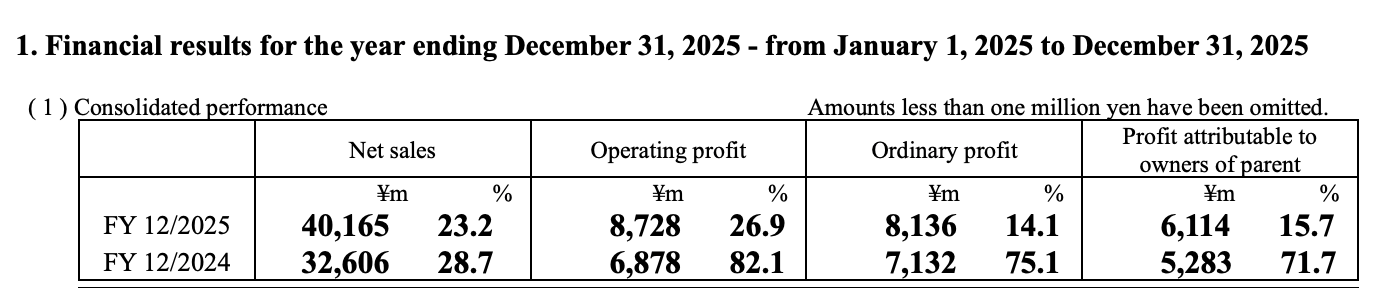

The results looked like deceleration:

Operating profit was likely impacted by doubling their investments in capacity.

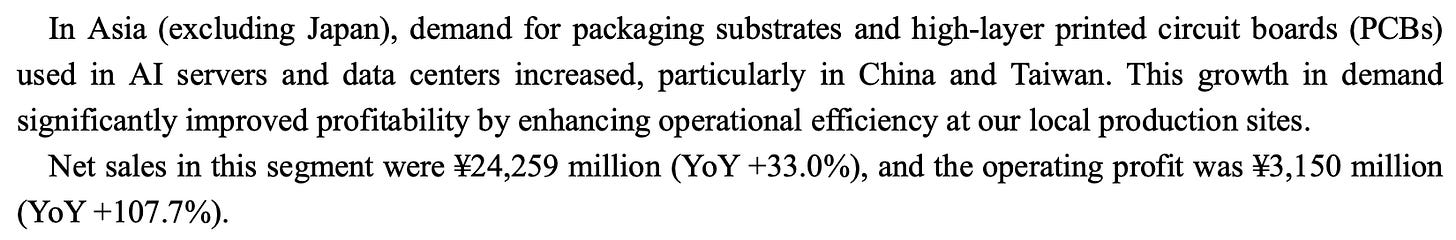

The picture is rosier if you zoom in on Asian PCB drill demand (ex Japan), where the AI PCB supply chain is concentrated:

For the reasons explained below the paywall, you would expect to see PCB drill demand to accelerate later this year.