APAC Roundup: 16 January 2026

TSMC & ASML, Micron, Resonac & Mitsui Kinzoku, ACMR, Ultra pure water, Bulgaria

It has been a barnstorming start to the year from Twitter and Substack. We will circulate a timeline this weekend so everyone in the community gets their flowers.

In today’s note:

TSMC and ASML

Micron insider buy

Resonac and Mitsui Kinzoku

ACMR and WFE comps

Ultra pure water suppliers for semiconductor manufacturing

Random shoutout to Bulgaria.

TSMC (2330) +3%

Their earnings transcript must be the most closely read document in my circle, approaching the care and scrutiny typically reserved for Shakespearean sonnets. For the Cliffnotes crowd:

CC Wei described AI as “real” and “endless”.

This weekend we will give out awards to those on Substack and Twitter who called the massive CapEx guide of $52bn to $56bn.

Forecasted total CapEx over the next three years will be significantly higher than the sum of the past three years. Hearing estimates of $150B to $190B.

What this means: A high-intensity semicap investment cycle has just begun.

CC Wei’s hesitation:

Doomers will point to his comment that he is “very nervous” about AI demand and that poorly calculated disasters would be “a big disaster for TSMC”.

Bulls will point to his comments about scrutinising the demand and the ROI on AI, and concluding that it is real and “endless”.

STF has a take about the gravity of TSMC’s CapEx decisions:

Implications for Intel - some see the CapEx as heading off the threat from Intel. In short, if TSMC cannot fulfill demand, it opens the door to Intel and Samsung to get more volumes, helping them develop into more threatening competitors.

Price action seems quite muted?

ASML: MS upgrades from €1000 to €1400; Bernstein thinks TSMC alone will order 30 EUV machines

Bernstein previously forecasted 62 EUV shipments in ‘26 but now thinks TSMC alone might account for 30.

This suggests Bernstein and AYZ’s bullish EUV shipment estimates for ‘26 might be too low.

Micron +3% AH as former TSMC Chairman, Dr Liu, reports US$7.8m purchase of shares at $337.

This is more of a fun fact than a serious signal because the purchase is a tiny % of Dr Liu’s $7B networth. The billionaire equivalent of subscribing to many Substacks:

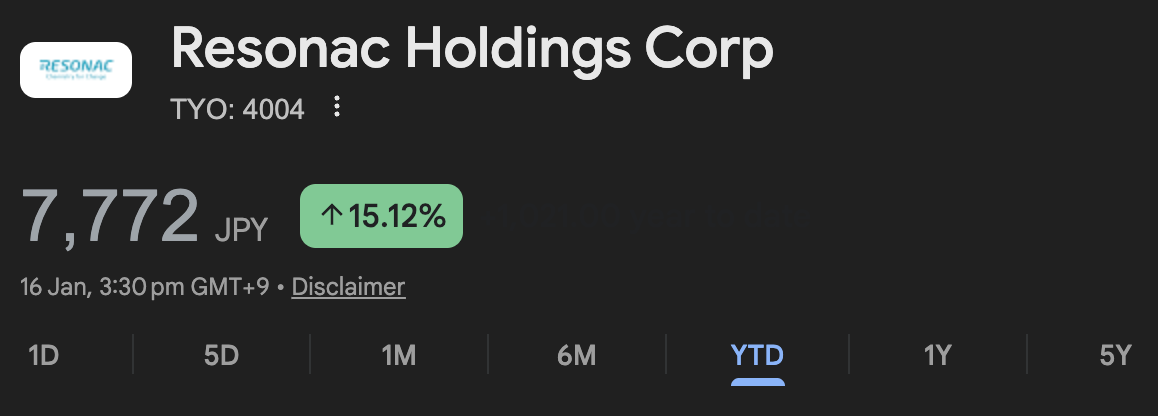

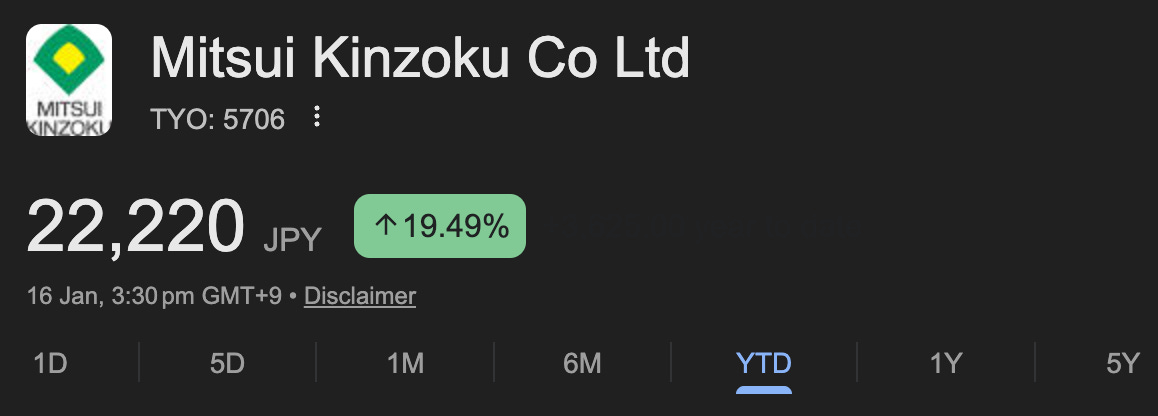

Resonac and Mitsui Kinzoku with new 52-week highs

Resonac raises prices of CCLs. We should try to rank these suppliers by their perceived willingness to raise prices.

GS initiated coverage on Mitsui Kinzoku on 14 January: