APAC Roundup: 23 January 2026

China, Mongolian mining, ACMR, Disco, AT&S, Malaysian manufacturing, Shinhan Financial

Good morning. Posts going out earlier for the next two weeks as I am in Melbourne.

China stimulus

China has issued the first batch of 93.6 billion yuan ($13.44 billion) of ultra-long-term special treasury bonds to support equipment upgrades, notably in energy. (RT)

Seen some calling out trucks as well - good for CYD? Worth looking into. Will also look for new ideas and keep an eye out for a dip in Harbin Electric.

Chinese rare earth stocks rally (Nikkei)

This Mongolian mining company caught my eye:

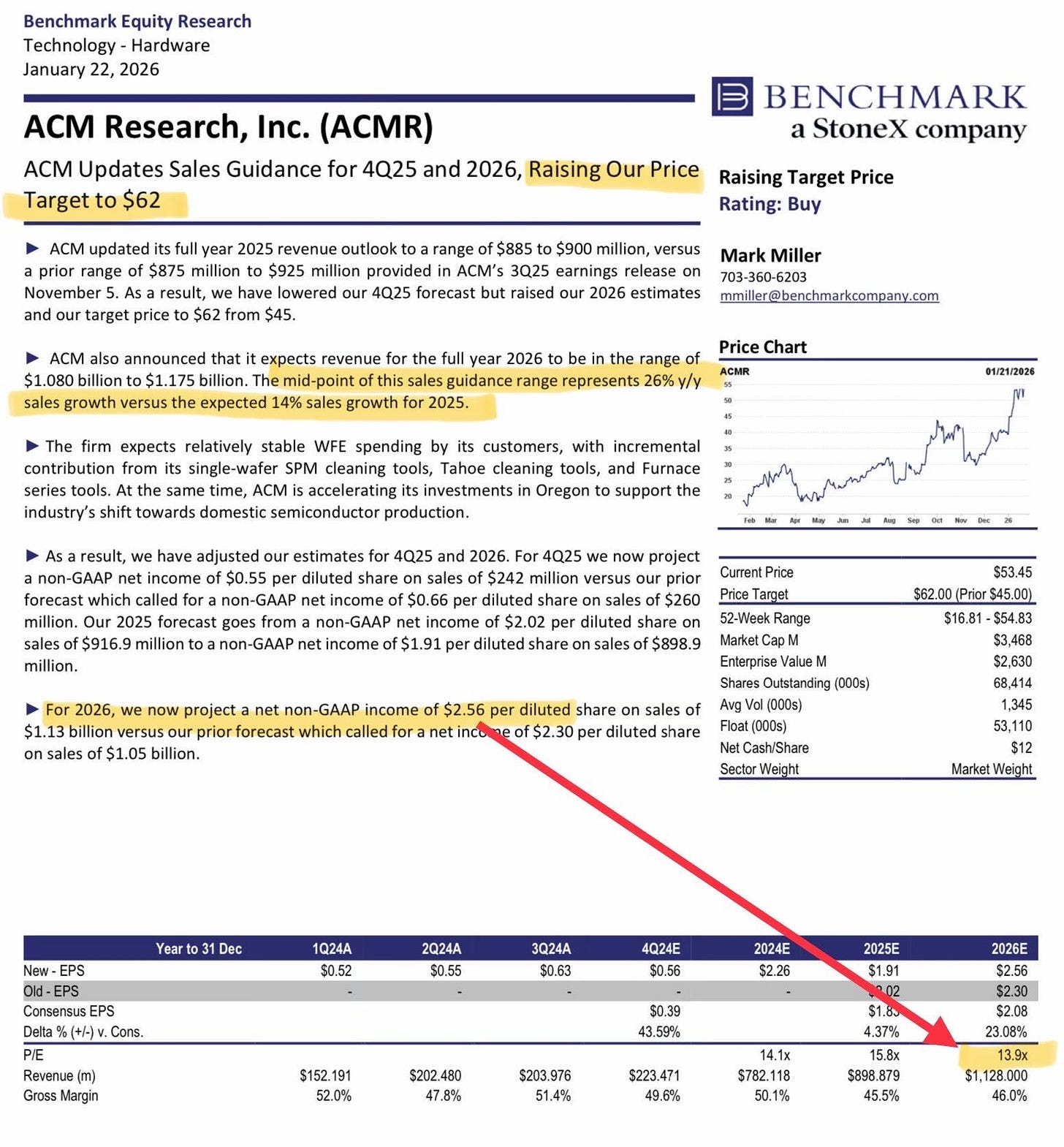

ACMR: Updates ‘25 and ‘26 revenue outlook; results out in late Feb (PR)

“We plan for a higher revenue growth rate in 2026 amidst healthy investments in production capacity and market share gains from our newer products,” said Dr. David Wang, ACM’s President and Chief Executive Officer. “We anticipate relatively stable WFE spending by our customers, with incremental contribution from our single-wafer SPM cleaning tools, Tahoe cleaning tools, and Furnace series tools. At the same time, we are accelerating our investments in Oregon to support the industry’s shift towards domestic semiconductor production.”

Benchmark note (h/t TheBenSchmark)

Disco Corp +17% yesterday (BBG)

Incidentally Toto, the Japanese toilet maker, is up 17% YTD because they also make electrostatic chucks, which are parts which come in contact with wafers (and quite difficult to manufacture).

Imagine not being bullish on Metasurface Technologies. Vacuum chambers are not as demanding to make but the news speaks to the investor appetite for anything semicap exposed.

AT&S: New 52-week high; tripling cleanroom space in Austria (PR)

Iqbal is doing well on this one.

AT&S appear to be responding to PCB demand, consistent with the GS PCB report. This company is also levered to AMD.

Might visit the Kulim facility for paid subs in Feb/March.

Malaysia smashes trade record (NST)

Speaking of Kulim:

From a sectoral perspective, manufactured goods recorded their highest value to date, remaining the key driver of Malaysia’s export growth in 2025.

Electrical and electronic products, machinery, equipment and parts, as well as optical and scientific equipment, all reached record highs.

More people are taking notice:

KOSPI 5,000 (BBG)

FWIW, I own Shinhan Financial in lieu of Singapore banks. New high yesterday.

Under the Hood has a writeup.

In hindsight, China is probably moving to EV trucks.