APAC Roundup: 3 February 2026

Great day for Japan; More upside for Teradyne?; ACMR; SiTime

Important point for the Teradyne call below the paywall today. Other than that, this post is about results coming out of Japan.

Sumitomo Electric +12.5%

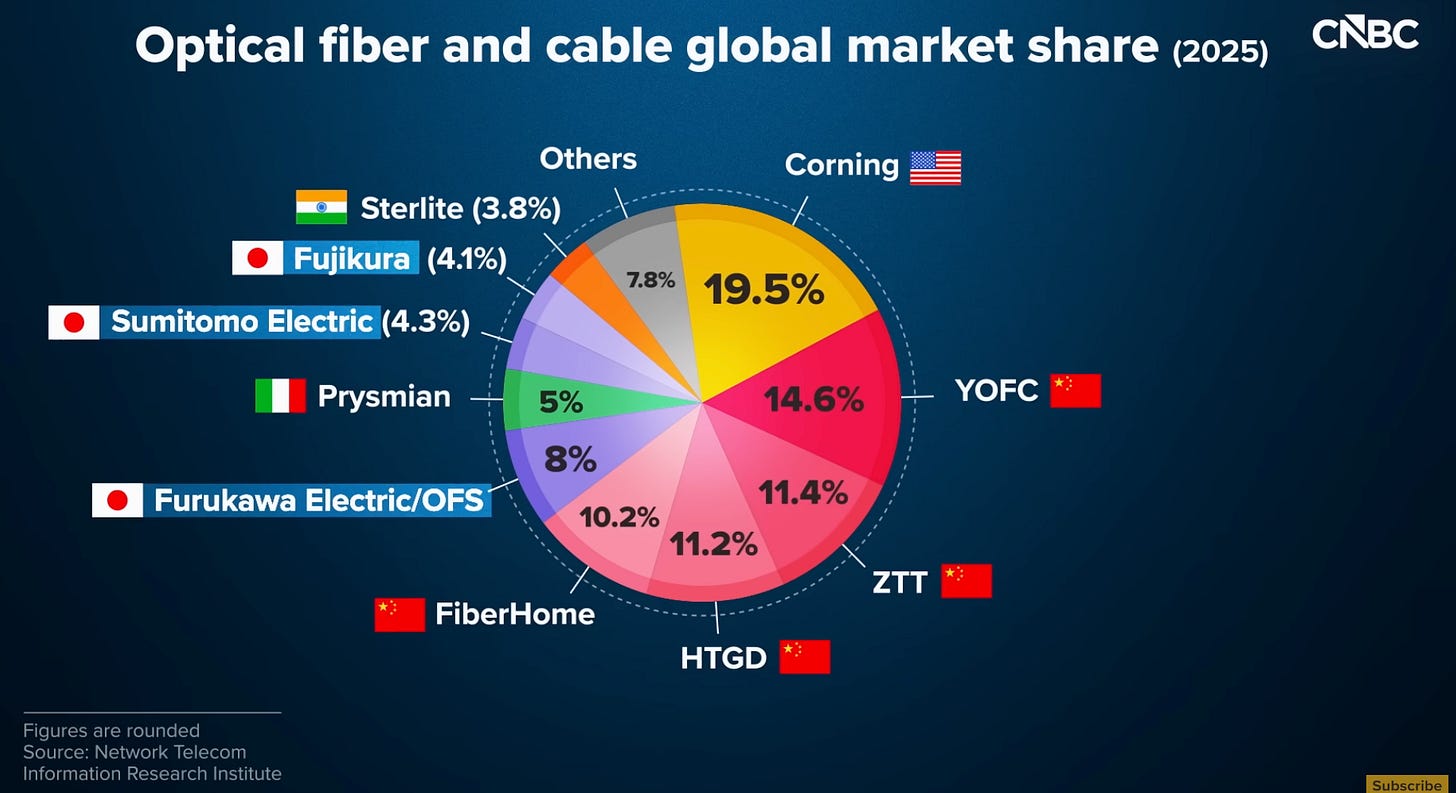

Following Corning’s US$6bn fiber deal with Meta, Sumitomo Electric raised full year profit forecasts today by 10%, driven by strong growth in its Infocomm segment.

As a reminder of where Japan sits next to Corning:

Great read through for Seikoh Giken, which was already up 10% earlier in the day. We would argue there is upside for Seikoh Giken:

As we flagged to readers back in December, Nikkei was reporting that Sumitomo Electric would be doubling capacity for optical devices in fiscal 2026 compared with the fiscal 2024.

Later that month, Nikkei put out another article reporting planned capacity increases across the value chain in Japan:

Japan's JX Advanced Metals plans to raise its production capacity for materials for optical communications in data centers a third time this fiscal year to keep up with demand for AI data centers.

Mitsubishi Electric aims to triple its fiscal 2024 capacity by fiscal 2028, while Sumitomo Electric Industries plans to double its fiscal 2024 production capacity by fiscal 2026.

Electrical cable maker Fujikura plans to invest 45 billion yen to build a new factory for fiber-optic cables in Sakura, Chiba prefecture. The company hopes to multiply fiscal 2025 sales for fiber-optic cables by 1.8 times on the year, once the new plant is fully operational.

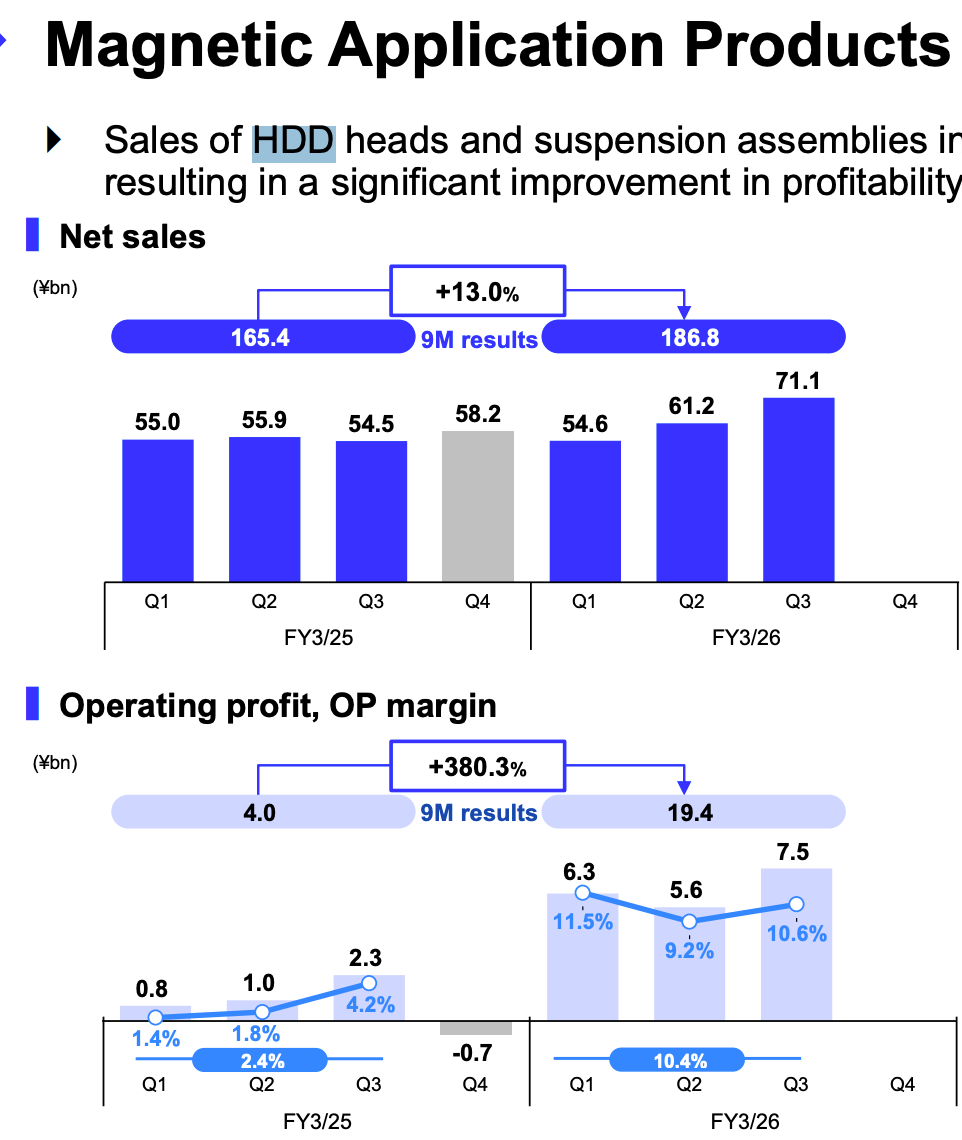

TDK Corp +11.4%

Once again, TDK’s HDD segment providing excellent read through for NHK Spring (+5.3%).

Kyocera +11.3%: Semicap subsystems, optics, capacitators, and more.

We previously noted how Japanese toilet maker Toto (BBG) was performing well this year due to its electrostatic chuck business.

An electrostatic chuck is a device that uses electrostatic force to hold an object - wafers, in the case of semiconductor manufacturing. Semicon e-chucks are difficult to manufacture.

Kyocera has a fast growing electrostatic chuck business too. They also have exposure to lots of other attractive markets:

Ceramic Packages for Optical Communications

High-Performance Multilayer Ceramic Capacitors (MLCCs).

Polymer Tantalum Capacitors

Perhaps the most excitement is around the buyback. BBG:

Kyocera Corp. plans to buy back as much as ¥500 billion ($3.2 billion) worth of its shares from fiscal 2027 through fiscal 2028, joining a growing number of Japanese companies repurchasing stock.

The Kyoto-based maker of electronics parts separately said it will sell about ¥250 billion worth of its stake in wireless carrier KDDI Corp. in fiscal 2027, part of a growing trend of cross-shareholding unwindings among major Japanese businesses.

Teradyne

Looking forward to the call. I’ll be looking out for one main point, I think. If confirmed, this would suggest upside even after the +25% move: