Japanese Picks and Shovels Update

Happy Lunar New Year.

Quick update before I get back to the holidays.

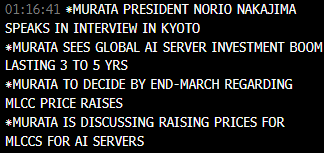

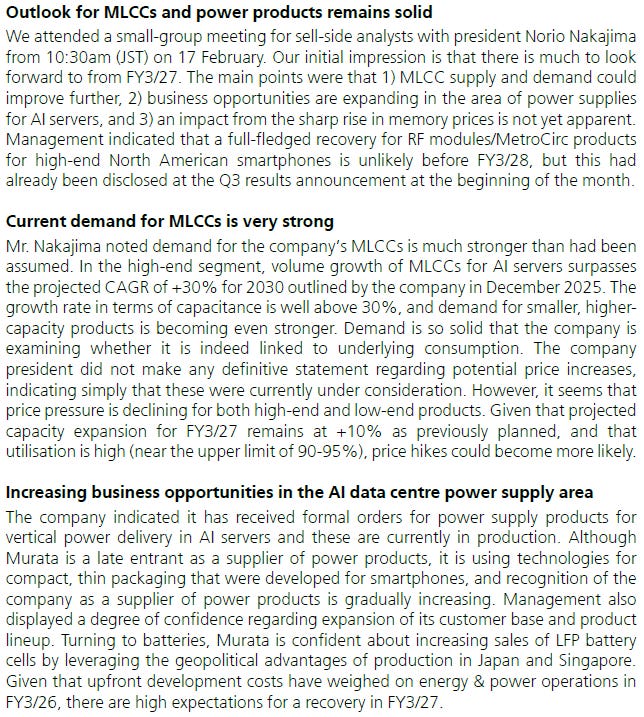

Murata Manufacturing

Seemed to cause a bounce in Japanese AI trade yesterday with these comments at a small analyst meeting:

UBS came away with a bullish take:

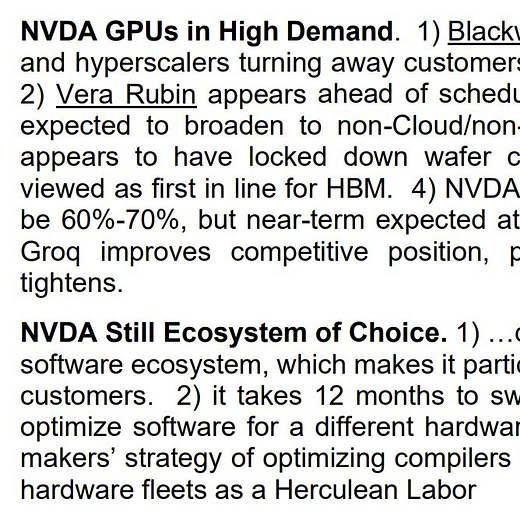

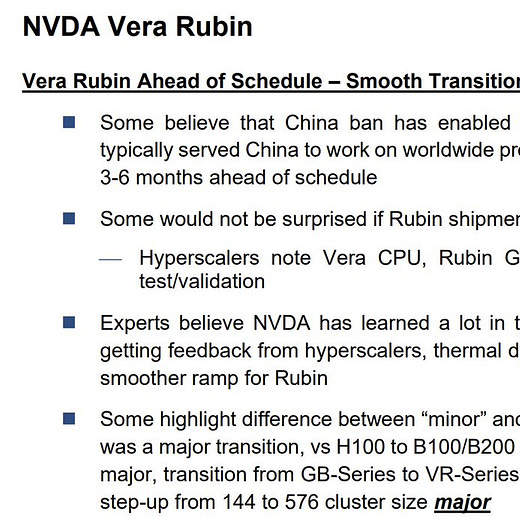

Vera Rubin ahead of schedule

Pick and shovel companies of all stripes should have a good day today on the back of this news that Vera Rubin is ahead of schedule.

You also have news of the multi-year Meta deal with Nvidia.

Union Tool took a while to respond, now up 4%. You would expect this if you have an exponential growth story tied to adoption next generation materials.

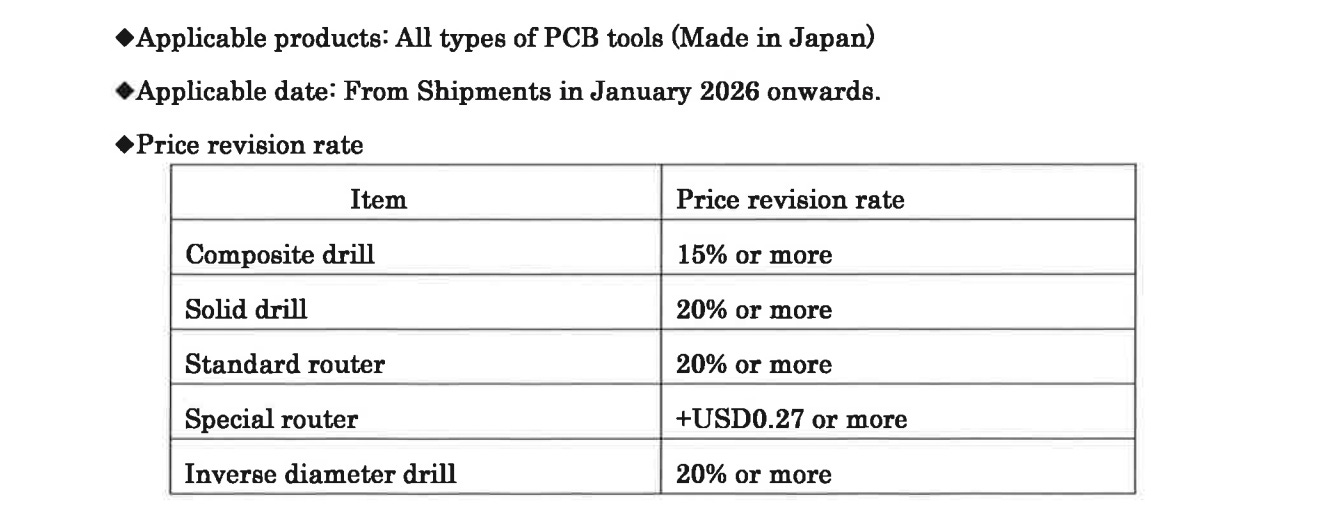

Also, a reminder that Union Tool price increases only kick in from January and are not reflected in results yet:

FWIW, Vera Rubin also signals adoption of 800v in data centers is ahead of schedule, which should be good for Murata, but the stock is flat.

I would expect Murata to trade in sympathy with a name with Vertiv (+3.8%).

Seikoh Giken

Seikoh Giken has easily cracked 23k yen this morning, validating the repeated top blasts the last two days.

Vera Rubin ahead of schedule likely means CPO ahead of schedule.

In simple terms, Seikoh Giken is demonstrating that tech changes are favouring the market leader, as there is little incentive to risk this change on untested players, for a cost saving that is insignificant relative to the value gained from the AI gold rush.

I am irresponsibly long Seikoh Giken now, and we will lighten up today in favour of our pick below.

The undiscovered pick and shovel play on HBM production

“Undiscovered” Japanese picks and shovels are getting more difficult to find. Our top pick is still undiscovered, judging how it is down ~10% despite good news confirming its earnings growth trajectory: