Japanese Construction Co Up 16% On Friday

0.8 P/BV in a tourism-driven construction boom

Please see our usual terms and conditions. By reading this post, you acknowledge and agree to the same.

Dear subscribers,

Meanwhile, Iqbal has written up a Japanese construction company. This idea struck me because of my visit to Karuizawa earlier this year:

I stayed at Shishi Iwa House, designed by Pritzker prize-winning architect Shigeru Ban.

Just across the road from the hotel there was a major construction project.

The owner noted that there was a boom in construction in Karuizawa driven by healthy growth in domestic and foreign tourism. Foreign investors like himself were struggling to persuade locals to sell land for lucrative new projects.

A Google search turns up many other examples of new investments in Karuizawa. Notably, the Anantara brand is launching a 51-key luxury resort in 2030.

In the wider region, foreign investor interest is also healthy. This is famous for having driven up land prices in Hakuba by 32.4% in 2025.

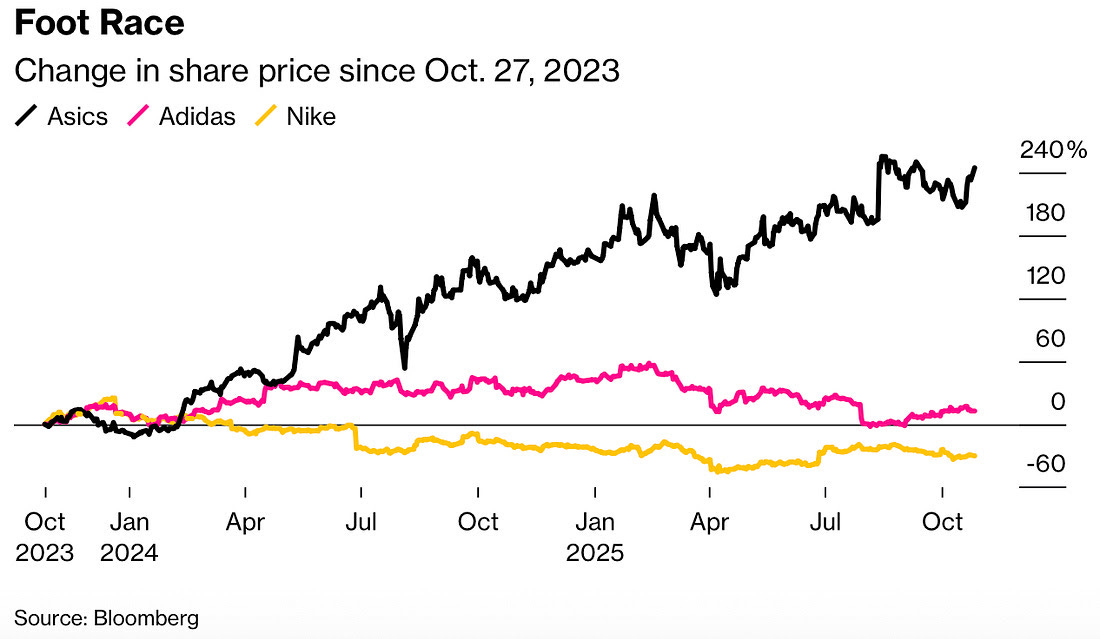

The Japanese tourism boom is also famous for having tripled the value of Asics shares in the last two years:

Under Sanae Takaichi’s premiership, this constructive environment may continue:

The consensus appears to be that the yen will continue to weaken, providing a tailwind for foreign tourism.

In her first policy speech, Takaichi has expressly called out promoting investment in semiconductors and energy. This aligns with her agenda of economic stimulus and protecting national security (by way of technological independence). This boom will, in theory, soak up construction capacity, leaving smaller construction firms to prosper in their respective niches.

Her administration is moving to pass a supplementary budget for FY2025 that is expected to exceed 13.9 trillion yen ($92 billion).

Japan generally has a stable public works budget (~1.5bn), and that looks set to continue in the near term. This, coupled with relentless tourism investments, is a great tailwind for the business Iqbal discusses below the paywall.