O&G manufacturer at ~2.6 EV/Ebit, 100% upside?

1/3 market cap in net cash raised at 2x the valuation in May 2025

Disclaimer: By reading this, you agree to our terms and conditions.

Credit to Archetype Capital for finding this. He thinks the upside is to 5 to 6 EV/Ebit.

Credit also to the Shell process engineer who talked me through this. I drew some comfort from the fact that he could tell me off the cuff which street the company’s Singapore facility was in, despite having been retired for ~ 10 years.

Behind the paywall is a note that includes some points from that call - we try to explain in lay terms what the business is and what appears to be working. This post has also been updated to reflect intel from my conversations at Singapore International Energy Week.

Any errors are my own. Please do your own DD as this is not comprehensive research nor financial advice.

OMS Energy Technologies, Inc. (OMSE) manufactures surface wellhead systems (SWS) and oil country tubular goods (OCTG).

It has a 50 year history and has been led by its current CEO, How Meng Hock, for more than 10 years. He is a mild mannered engineer from Malaysia who spent a long career at various O&G brandnames before executing an MBO from Sumitomo Corporation in 2023. He ostensibly did the MBO to save jobs and to free the company from the bureaucratic neglect of Sumitomo. He now owns 61.78% of the company.

You can get a measure of the man from this Youtube video, and this podcast.

FWIW, I also liked the copy of their various posts on LinkedIn, which gave the impression of a responsible, purpose-driven business. Mr How’s own description of his management philosophy is also impressive:

OMS listed at US$9 in May 2025. In the video, the CEO explains they listed primarily for profile and in pursuit of institutional ownership. We understand he is also hunting for acquisitions to add to their product portfolio with their new financial position.

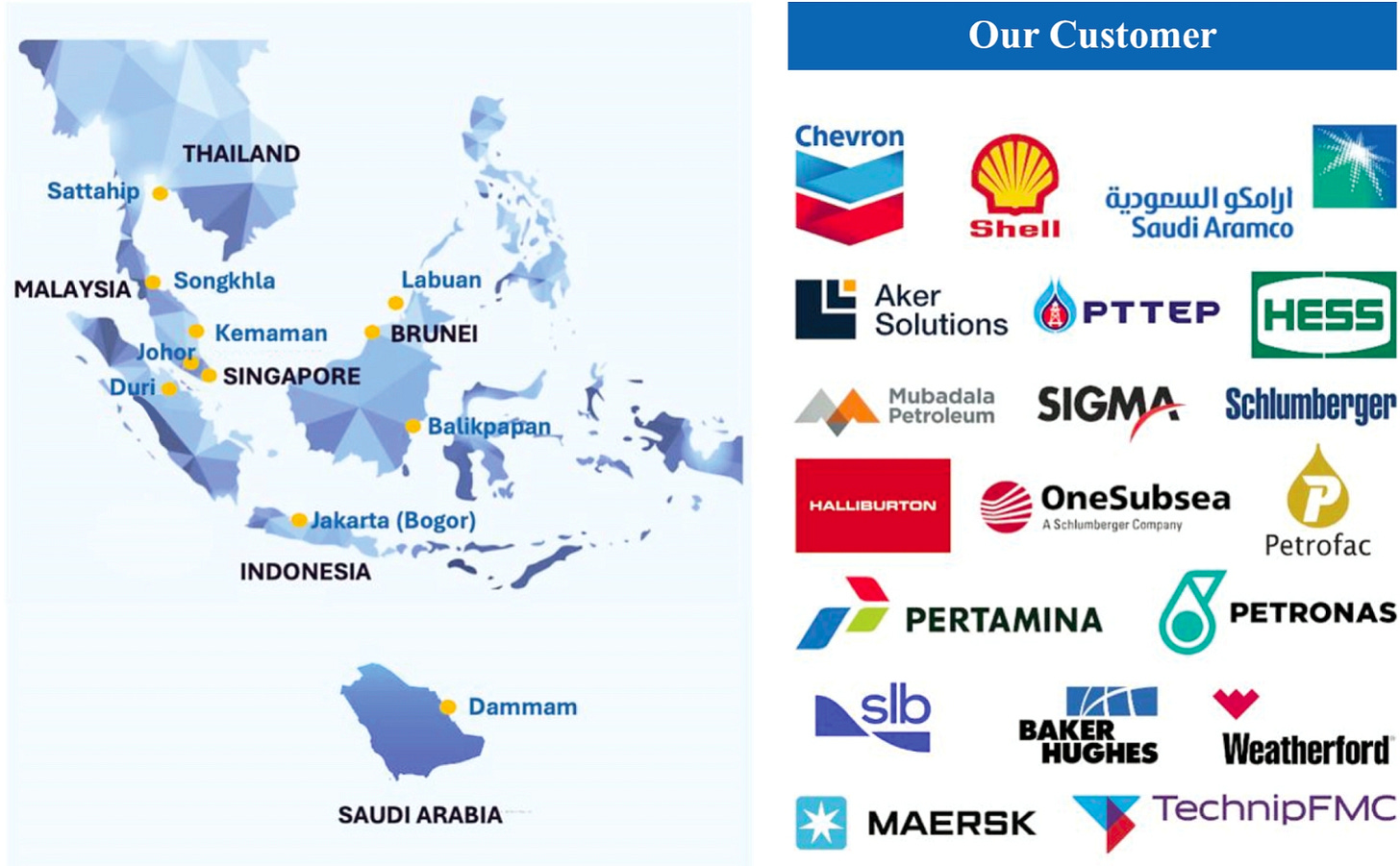

The company operates across SEA and in Saudi Arabia. It has successfully executed a localisation strategy that has led to a lucrative relationship with Saudi Aramco (67% of revs), but which is also being executed in Malaysia, Thailand, Indonesia, Brunei and potentially other jurisdictions like Pakistan.

In lay terms, the business segments are:

Specialty Connectors and Pipes: Large and highly engineered connectors used in demanding environments. OMS manufactures its proprietary products at precision machine facilities in Singapore, Indonesia and Saudi Arabia. However, Saudi Aramco accounted for 99% of the revenue in this segment in FY25.

[Update: I confirmed with OMS that these products are used for well construction and are appropriate for both oil and gas wells]

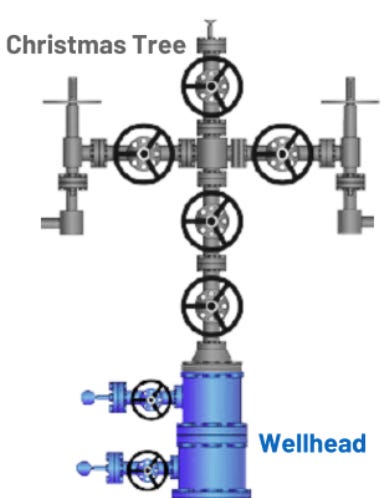

Surface Wellhead & Christmas Trees: This is the equipment you see at the very top of a well on the surface. The wellhead is the base assembly that seals off the well. The “Christmas tree” is essentially a complex arrangement of taps that controls flow of gas or oil. OMS also designs, qualifies (to intl standards) and manufactures its own solutions. Manufacturing is in Singapore and Indonesia. Indonesia accounted for 82% of this segment’s revenues in FY25.

Premium Threading Services: This is a specialized manufacturing service. The company uses licensed technology to cut high-performance, precision-engineered screw threads onto tubular equipment used in drilling. This segment is highly profitable and contributed 18% of revenues in FY25.

In essence, OMS’s business model involves sourcing foundational materials like steel and conductor pipes and then applying its proprietary designs, engineering expertise, and advanced manufacturing techniques to produce its speciality products.

Further, it appears the strategy is to forge close partnerships with clients by developing responsive, localised manufacturing and service capabilities. Operating 11 manufacturing facilities in six jurisdictions, OMSE embeds itself into the supply chains of national oil companies (NOCs) and aligns itself with nationalization programs like Saudi Aramco’s “In-Kingdom Total Value Add” (IKTVA) and Indonesia’s “Tingkat Komponen Dalam Negeri” (TKDN).

Risks

While OMS has a 10-year contract with Aramco valid until 2033, the agreement contains no minimum purchase obligations and allows Aramco to terminate for convenience with just 30 days’ notice.

My ballpark estimate of downside in the event they lose Aramco as a customer is ~80%. Is the risk remote given that they have had a presence in Saudi Arabia since 2008 and now have a large manufacturing presence there? Aramco also attended the opening of the facility in 2022 and likely have an interest in supporting Saudis employed in country in the supply chain.

What about Aramco production levels? Aramco spent ~136m last year despite not increasing oil production. Aramco is keeping oil production levels steady in 2025 but will need to keep drilling and maintaining existing wells to do so. Aramco is also expanding gas exploration and drilling significantly, which may help support or even grow revenues. I drew some comfort from Vallourec’s impressive Aramco revenues in years where production was down or flat.

Corporate governance and key man risks- How Meng Hock owns 61.78% of the company and appears to be the chief architect of its recent success.

Comps

The closest comp is Innovex, which trades at ~7.2x LTM EV/Ebitda.

[Update: Cactus (WHD) is also a comp and is also around 7x EV/Ebitda]

OMS deserves a discount for being a minor player and for the customer concentration. On the other hand, Saudi Aramco is powerful validation and the company appears to be successfully diversifying (1, 2). One could argue 4 to 6 x EV/Ebit is appropriate.

Further reading

Archtype Capital:

Thank you!