PLAB, GEV, BE and some US reshoring ideas

American Industrial Power, for a change

Photronics +45%

Photronics is the only US-based photomask producer and counts Toppan/Tekscend and DNP (both Japanese) as competitors. This one is being talked about alot by a 360k follower account.

Move driven by good earnings today, closing valuation gap with Tekscend ($429A)

Several references to reshoring on the earnings call. We flag other US reshoring beneficiaries below the paywall.

Semiconductor manufacturing continues to diversify globally, including meaningful reshoring of production in the U.S. We are a market leader in the U.S. and will pursue numerous higher-end opportunities through our U.S. investment plans.

More specifically, a year ago, we announced our capacity expansion and capability extension at our Allen, Texas facility. We expect to begin tool installation in the coming months with customer qualifications in the spring time frame and initial revenue later in 2026.

High-end IC strength reflects strong order patterns globally, including in the U.S., which now represent 20% of total revenue, where reshoring efforts continue to create a favorable demand environment.

I’ll just add something quickly that, I guess, stating the obvious, right, the regionalization trends, essentially, there will be more fabs making more wafers, they’ll need more photomasks. So the trend -- the regionalization trend is only positive for merchant photomask manufacturers like Photronics.

GEV +15% and ENR.DE

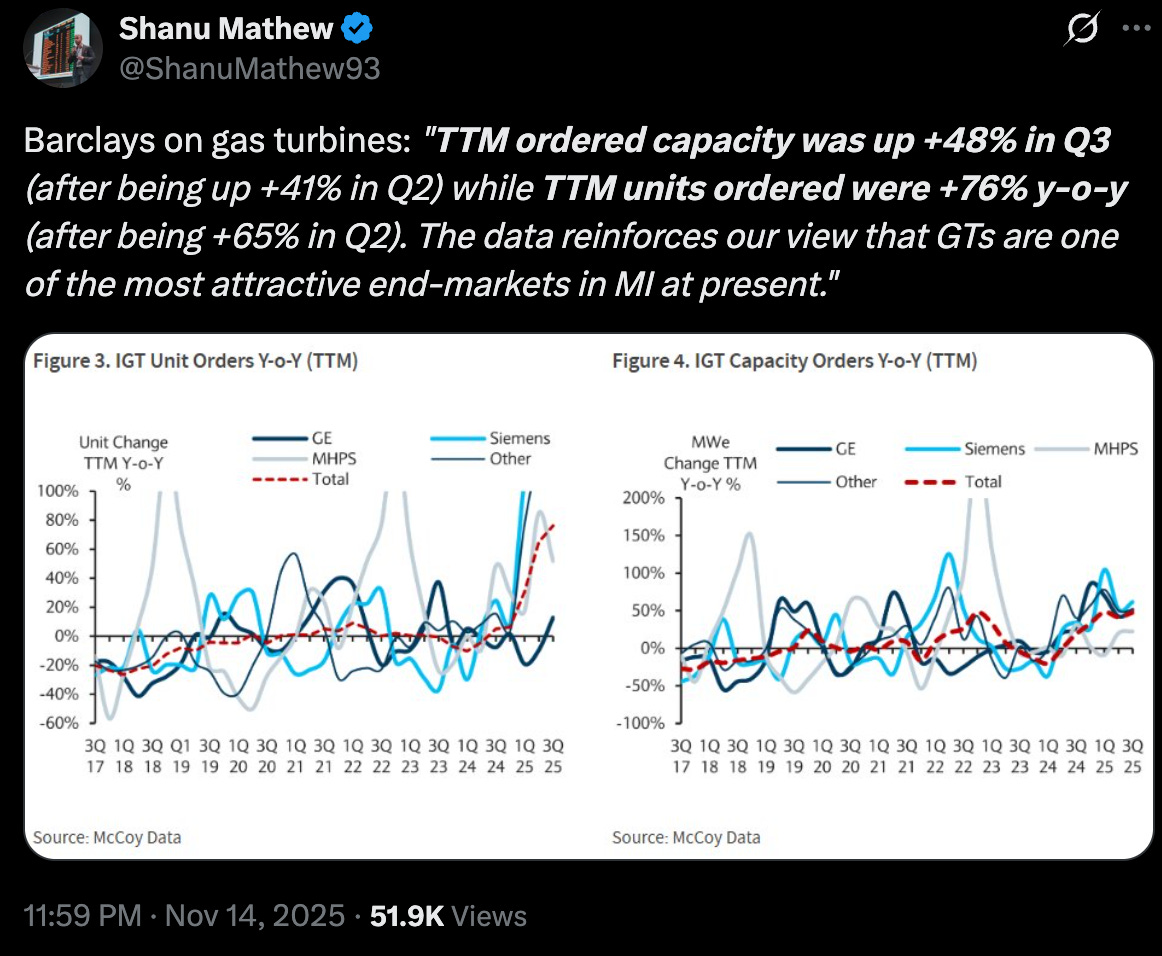

Barclays thinks gas turbines are one of the most attractive end-markets in Machine Intelligence: link.

One might expect the Siemens Energy valuation to catch up:

MSFT turning attention to Europe in its AI strategy. Investing 10B in Portugal.

More news on European DCs.

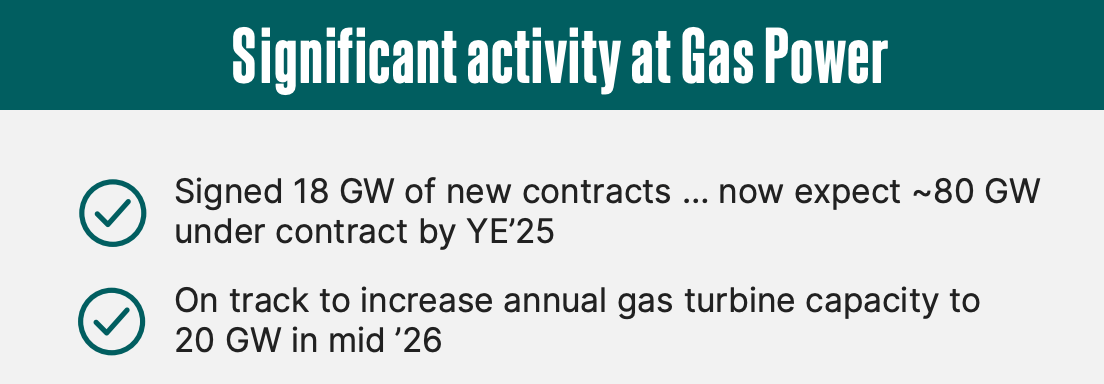

LTSAs are massively profitable for GEV and should be for Siemens too.

Bloom Energy -7.45% and -2% AH

GEV announcing development of fuel cells. See Analyst Day slides:

Sentiment also affected by GEV increase in capacity?

Gas turbine vs BE economics discussed here.

Oracle -10% AH pulling BE down.

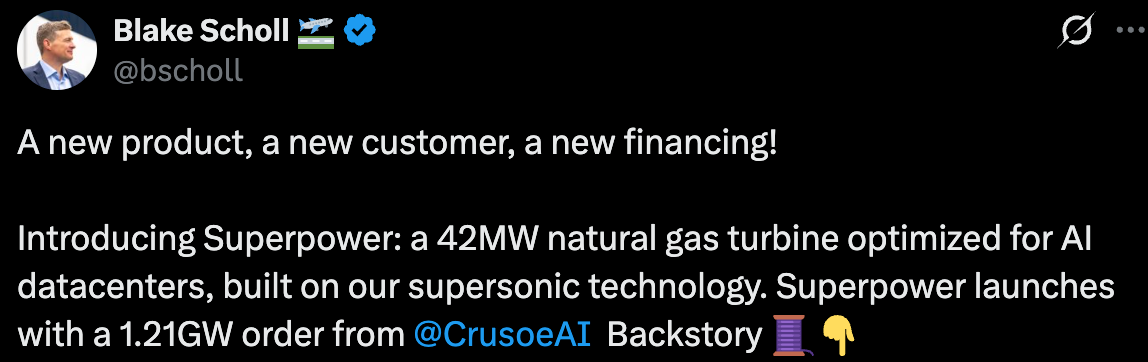

Finally, you also have new entrant Supersonic, who plans to produce 7.5GW of kit in the next five years.

Supersonic is also making alot of its parts itself!

Staying on the reshoring theme, the other beneficiaries are…