Singapore roundup #1

Construction activity, Soilbuild, new idea 1, XMH, Tai Sin Electric, Centurion, and Thakral

This is a quick fire update on some Singapore industrials / RE ideas that I follow.

Singapore construction activity

It is one thing to hear about a theme and see some forecasts. It is quite another to break down what the forecasted spend actually gets you and see the construction in person.

The Building and Construction Authority’s mid-year update shows that Singapore is on track for $60 bn in construction demand this year, handily exceeding the top end forecast of $53 bn.

I want to call out the public residential and institutional (healthcare, schools, etc) spend. Those are on track for $12.5 bn and $18.2 bn, respectively, also ahead of top end of forecasts.

These are the tailwinds driving the growth in Soilbuild’s precast business, which they highlighted in previous announcements:

Is this growth peaking?

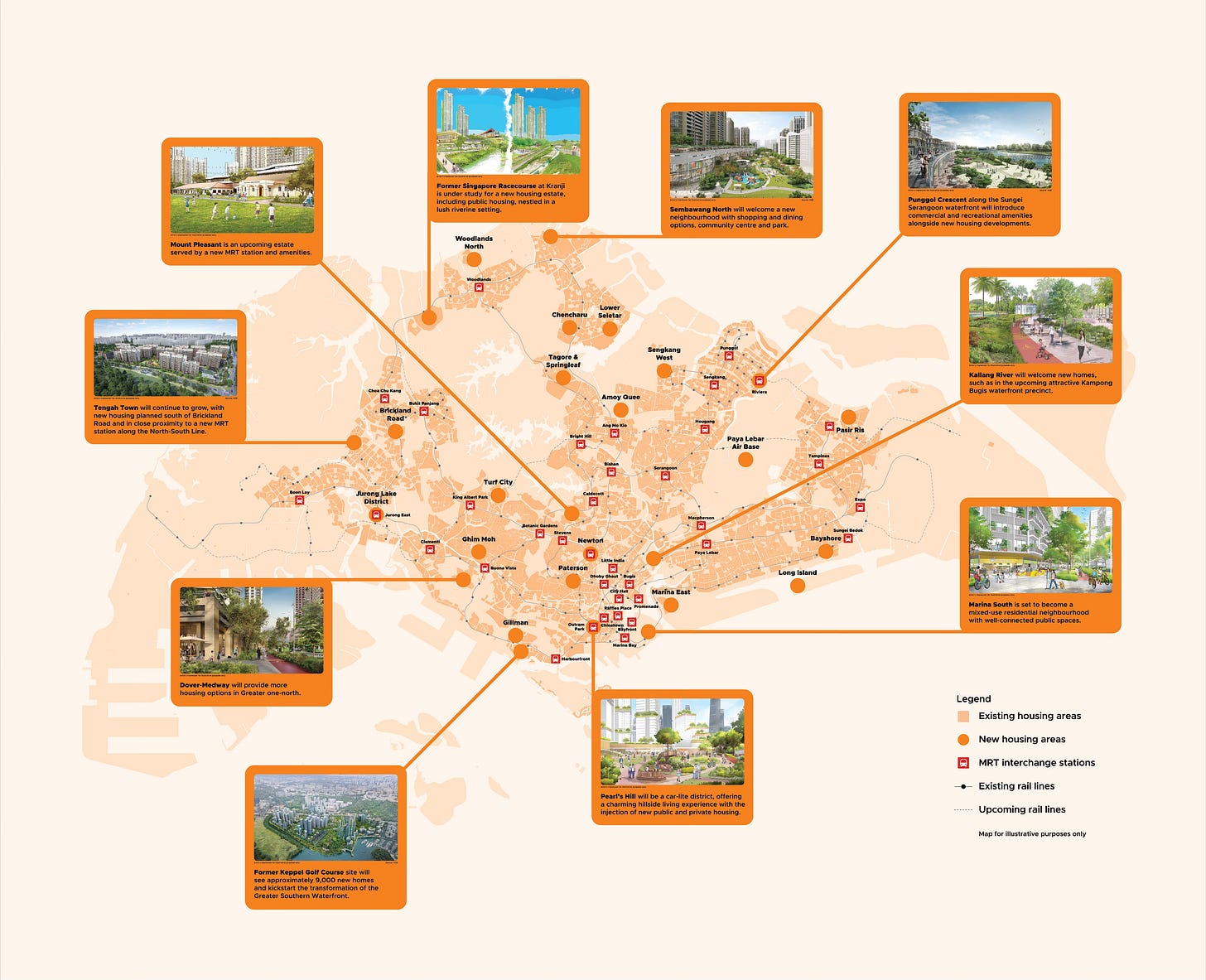

A quite staggering statistic is that Singapore intends to build 27 new residential hubs in the next 10 to 15 years. This is represented by an orange circle in the map below from the Urban Redevelopment Authority’s 2025 draft masterplan.

Each circle will require several public housing projects, a school in some proximity, healthcare facilities, and civic and community buildings. My own ball park estimates drawn from government announcements are ~100 public housing projects (around 55k units), 50% more nursing homes, 8 polyclinics, 10 new and redeveloped schools, 3 community hubs, and 2 hospitals.

Soilbuild wins regardless of the contractor that wins these tenders.

There is also a new construction idea that is being circulated to paid subscribers, who are now giving input on a draft write up. This company trades at < 4 PE, has close to 2x its market cap in cash, is exclusively focused on public housing, healthcare and education, and works to distinguish itself from peers on every other relevant metric. It also proposed a 7% dividend just before its latest results.

XMH Holdings (BQF)

This company may be seen as a maritime engine dealer but also has a subsidiary that supplies data centres with diesel backup generators. That subsidiary can loosely be labelled Singapore’s own Power Solutions International (PSIX).

Weichai Power, a manufacturer of diesel engines, has a significant stake in PSIX. Similarly, Mitsubishi Power Asia Pacific has purchased a 15% interest in XMH’s Mech-Power Generator, for a low teens p/e multiple.

Mitsubishi’s involvement at the price paid suggests they think the business will grow. It eases concerns about the reliability of XMH’s supplier, opens more doors to potential customers, and is a helpful selling point.

This confirmed partnership accords with a few things management said at its recent AGM, now recorded in minutes:

XMH’s principal suppliers are “well-positioned to strategically support” the group to achieve the short lead times demanded by data centre customers.

XMH intends to expand the diesel generator facility in Johor. At the time, they were likely not at liberty to explain that this would be supported by Mitsubishi.

The company’s momentum was interrupted by their Indonesian marine subsidiary receiving a S$11m tax assessment for FY24, a year in which the entire group only did S$27 million in distribution and after-sales profit globally. The company now trades below 7 PE again.

Investors are now likely weighing whether Indonesia will look back even further and the likely tax impact on this year. A more bullish view is that XMH has done nothing inappropriate by selling engines by way of its Singapore subsidiary (and paying the lower 17% corporate tax rate on that profit) and providing after-sales services by way of its Indonesian subsidiary - pointing to the high success rate of the tax payer in the Indonesian tax courts and the double taxation treaty between Singapore and Indonesia.

Despite this being likely to hang over the company without an update for at least 12 months, the share price has held up reasonably well, perhaps reflecting a slight increase in discount rate and tax rate assumptions, and a small group of loyal shareholders. More Mitsubishi news could renew wider interest in the company.

Tai Sin Electric (500)

This company is a leading Singaporean manufacturer and distributor of cables and electrical products. On the watchlist because it grew revenue 20% and earnings 77% last year. Cables account for a surprisingly large percentage of infrastructure budgets and Singapore has arguably yet to hit peak spend. The thesis is that the cables for the MRT lines, the Marina Bay hotel extension, Changi Airport terminal 5, and the data centres in Singapore, Johor and Vietnam will only be ordered some time in the next three years. Investors have also shrugged off concerns about copper supply, despite all the news around the looming supply crunch.

Centurion (OU8)

In an earlier post, I speculated that retail would dump Centurion in favor of its REIT listing last week, driven by confusion around the consideration received from the REIT for the seed assets and the preference of more directly owning real estate with an attractive yield.

I am reluctant to claim that I was right because the divergence was much more powerful than I expected. Centurion traded down to S$1.44 and a move down to NAV territory was a possibility before the Chairman purchased 200k shares yesterday, which seems to have reassured the market for now. The REIT currently yields around 6.5% and I would be interested to see if Singapore will send this down to a 5.5% yield, implying a S$ 1.20 price. The asset class is attractive because demand and supply of foreign worker accommodation is very visible and heavily influenced by the Ministry of Manpower.

Thakral Corporation (AWI)

Thakral is nearing an IPO of its Beauty Tech Group investment that would see the company receive up to 6.7% of its market cap in cash.

The company will confirm what it intends to do with the proceeds once the price and amount to be sold is confirmed.

Yesterday, one of Thakral’s Osaka properties was sold, unlocking S$6.4m in cash flow and S$2m in profit. Thakral also bought back S$135k in shares (0.85% of o/s), setting a new floor of S$1.57 after its previous buyback in the S$1.40s.

One might reasonably expect the IPO to encourage a quicker buyback pace.

Disclaimer: I have positions in all aforementioned companies. This is not a recommendation to buy or sell stocks. These are my personal notes from research derived from sources that I believe to be reliable. There is no representation as to the accuracy or completeness of the research. The information contained in this publication is not intended to constitute individual investment advice and is not designed to meet your personal financial situation. The opinions expressed in here are my own and are subject to change without notice.

Great post, thank you!