Singapore roundup #2

Kwan Yong, Soilbuild, Thakral, XMH, and two new ideas.

This is the second quick fire update on Singapore industrials that I follow.

Kwan Yong Holdings (9998.hk)

This company created a buzz among subscribers when we found it and it is now up ~40%.

It still trades at a discount to many peers at below 5 PE with a substantial amount if not all of the market cap in excess cash. Some peers trade at a premium despite primarily being a subcontractor - Huationg and CTR Holdings come to mind.

The company did not tender for a hospital in Tengah (a large new residential area) and narrowly lost a tender for another HDB project. However, there are still many shots on goal in the tender book I have reconstructed (paywall) by going through the government procurement site.

One could argue this deserves to at least trade at the value of the cash, which is ~40% upside from here. Remarkably you can still find sellers in the HK$ 0.45 range.

Soilbuild Construction (V5Q)

We know that the money MAS seeded with Fullerton for the purpose of drumming up interest in small and midcaps is now being deployed because a company called iFAST has reported them as a significant shareholder.

Soilbuild’s 20% move since the last roundup suggests some institutional interest here too.

While Soilbuild is a relatively high quality name, I like the industrial property space a little less than Kwan Yong’s niche because there is a lot of industrial property coming online in the next two years and have no insight into the continued strength of FDI in Singapore beyond 2028. I will lay that out in a forthcoming post.

Interestingly, a third generation leader of a large industrial property developer and construction company was also rather cool on industrial property and told me he liked the predictable flow of public housing. I get some pushback on that from local retail investors, some of whom argue that public housing contractors made little money in the last boom, a point I have yet to follow up on.

Thakral Corporation (AWI)

Beauty Tech Group IPO is now complete, giving Thakral S$13.1m in cash, or around 6.4% of its market cap at the time of writing. Thakral still holds around 6% of the company.

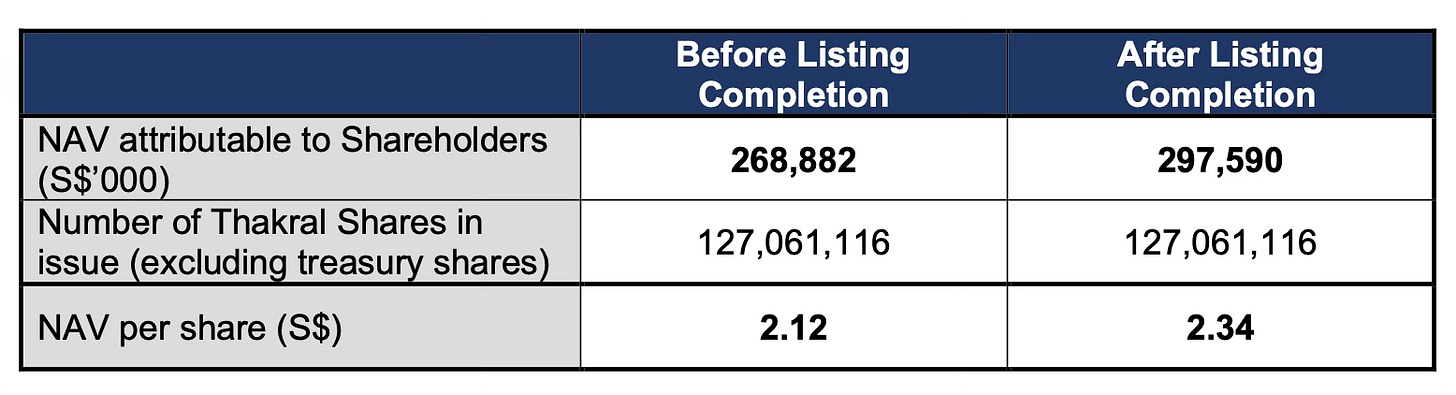

Management says its NAV is now S$ 2.34 per share.

They appear to be serious about closing the discount, but are not going about it particularly aggressively. I will continue to monitor the buyback.

Thakral distributes DJI drones in South Asia and Nespresso in India. As one person in the consumer electronics space in Singapore put it, they are the family to beat (or emulate) in this business.

XMH Holdings

I spent an inordinate amount of time at the data center trade show in Singapore last week working out where this company is going, the company that effectively launched this newsletter.

In summary, if everyone I spoke to is to be believed:

Mitsubishi will have a Johor factory capable of supporting 1,000 units of gensets a year soon - they are at 600 now.

They are launching a “new” genset model that they are aiming to price at around USD 900k (all-in cost for the end user).

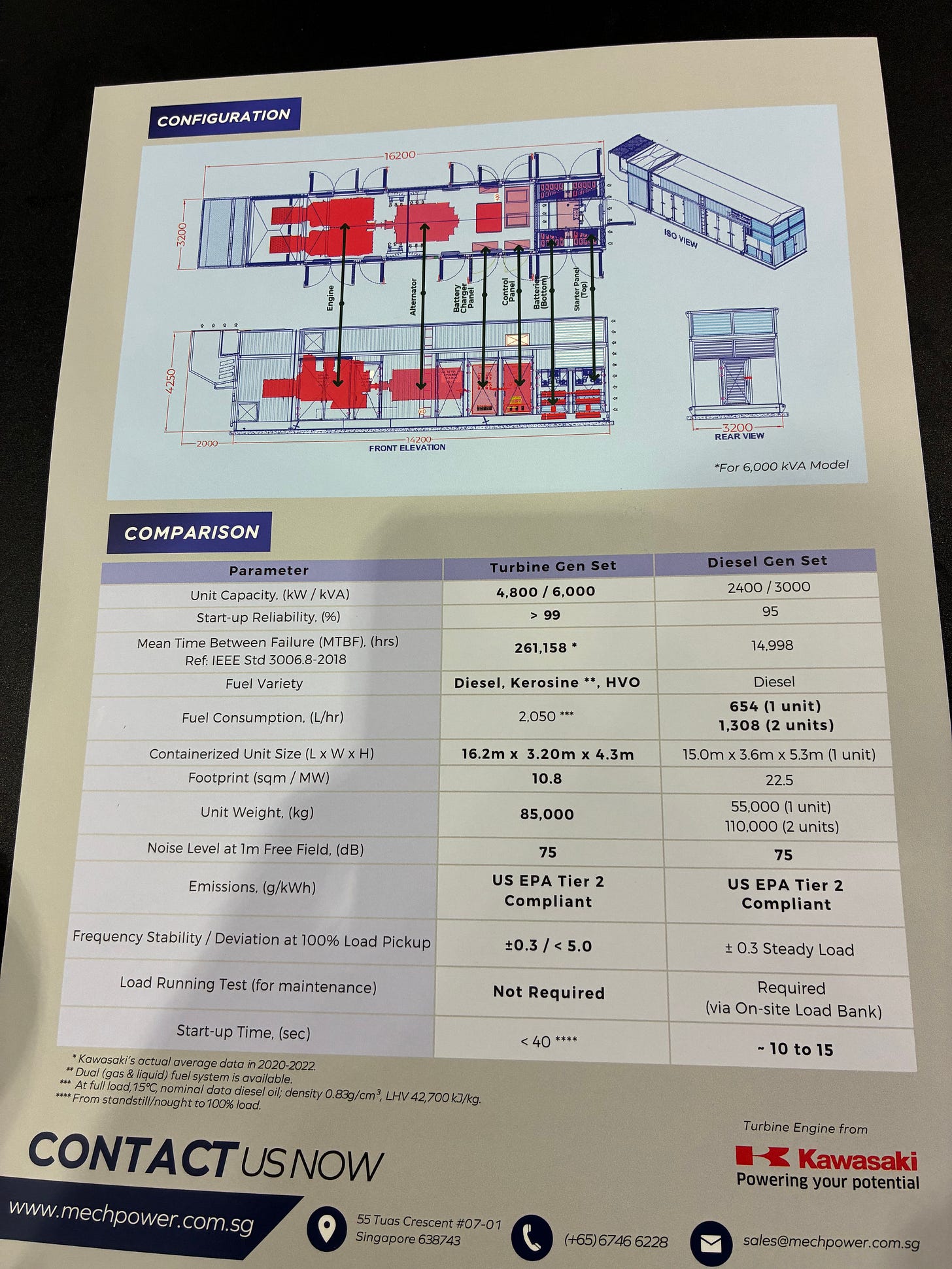

I also discovered XMH is working with Kawasaki to market some gas gensets. These are larger and more expensive than Mitsubishi’s diesel gensets, at approximately USD 3.5m a piece.

Finally I believe XMH is shortly going to announce how it is expanding capacity in Johor. Details here. The Mitsubishi acquisition of its 15% stake in Mechpower was completed on Friday.

Looking ahead, we are digging into two AI beneficiaries trading below TBV and at low single digit PE. Both names were discovered by following a thread picked up at the trade show. I look forward to developing the ideas in the subscriber chat. Do consider a subscription if you would like to participate.

We now have 35 paying subscribers, soon to be 37 with someone buying two seats shortly. Thank you all for supporting the research - its hard work!

[Correction: this post previously said Mitsubishi acquired Mechpower. Rather, it acquired a 15% stake in Mechpower]