Singapore update #6

New DC capacity, metalenses, and the field trips to Johor

Dear subscribers,

We are gradually looking beyond Singapore for ideas. This is what travel in Q1 ‘26 tentatively looks like:

Kuala Lumpur, Malaysia, to meet entrepreneurs, principally in power.

Wasion’s factory in Johor, which supplies modular data center solutions, to check in on their ramp up to US$ 280M in revenue.

Kulim Tech Park, home to Intel, Infineon, Celestica, AT&S, Fuji Electric, and Hoya.

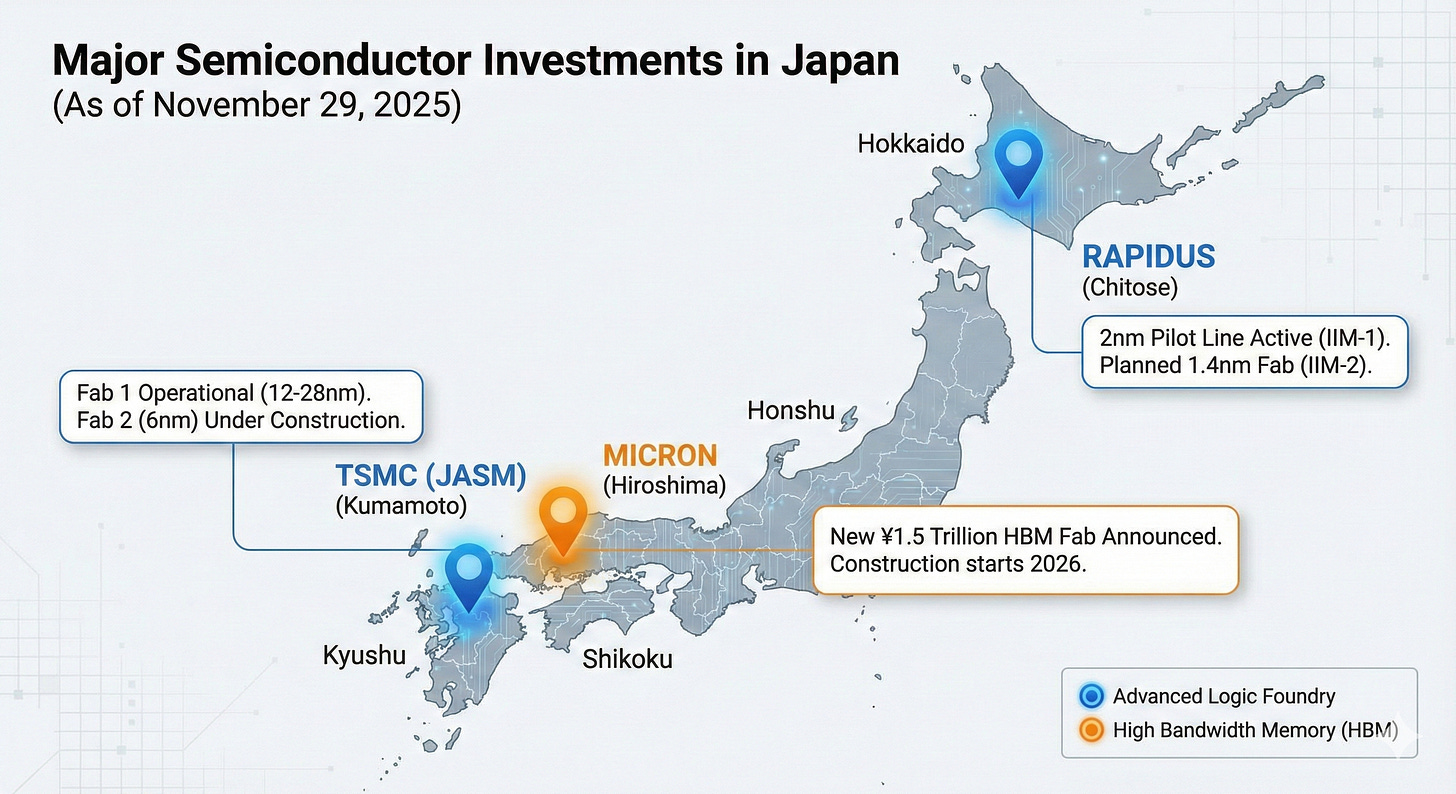

Japan’s various high-end semiconductor corridors in February. We are looking into some ideas in the Japanese semicon ecosystem, including precision engineering firms, M&E contractors, and utilities.

We expect to raise prices in January because of the increased travel. Now is a good time to lock in rates if the above sounds interesting to you.

This is our sixth Singapore roundup. We will continue to do this, albeit less frequently, to keep tabs on the companies we follow.

2025 GDP growth forecast upgraded to 4%

Commentary from the Ministry of Trade and Industry:

Strengths in Q3:

Transport engineering - Aerospace MRO and marine engineering were strongest performers in manufacturing. Good read through for aluminium suppliers.

Construction also strong but slowed from Q2. It turns out there is some seasonality here - Q2 weather is better and there is a rush to catch up on work following Chinese New Year.

The report specifically mentions public housing and civil engineering and sees continued strength on those fronts next year.

Good for $9998.hk and others like Huationg perhaps. Notably, 31% of the increase in public sector payments were driven by institutional buildings, i.e. the support system for public housing.

Singapore progresses 700MW in new DC capacity

This week, Singapore opened applications to develop at least 200MW in new DC capacity.

We clarified with the government that this is part of the 700MW envisaged on Jurong Island.

This is relevant to XMH Holdings (diesel gensets and announcing results in a few days), CTR Holdings (structural works), Tai Sin Electric (200MW = potentially US$ 20M in LV cables), as well as various listed M&E contractors.

Metaoptics Ltd (9MT.SI)

The stock is up ~80% since our last update.