APAC Roundup: 13 January 2026

DBS on the AI trade; SK Hynix announces new plant; ASMPT; Semicap subsystems; Photonics complex.

Risk on continues in Asia

CIO of DBS, SE Asia’s biggest bank: “AI-related optimism is based on sound fundamentals” (BT)

BT also with a “Sell America” narrative:

On Substack:

SK Hynix -1.5%: New US$12.9B investment in advanced chip packaging plant in South Korea (RT)

ASMPT +3.6%

However, see reported feedback on ASMPT from Hynix, citing an unidentified industry source:

BESI +7% on Pre announcement and PT hikes

Be Semiconductor yesterday:

Preliminary unaudited orders for 4Q25 reached approximately €250M, an increase of approximately €75M, or 43%, versus 3Q25 and an increase of 105% versus 4Q24. For the 2H25, orders were approximately €425M, an increase of 63% versus 1H25.

JPM PT increased to €172, MS to €175, ING to €200.

Metasurface Technologies (8637.hk) +11%

Noticed that Fabricated Knowledge made this prediction over the weekend.

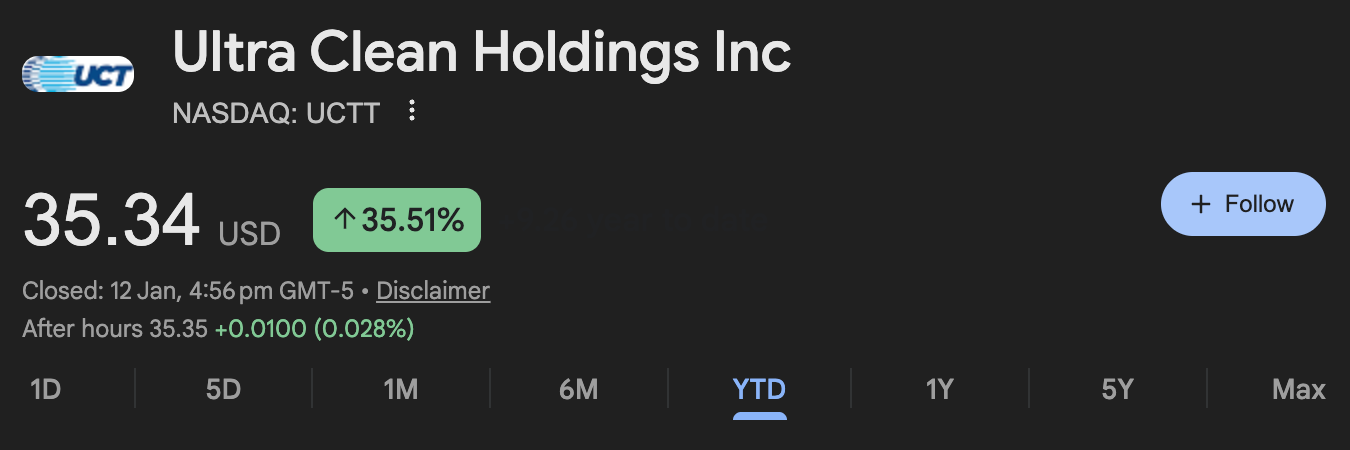

He calls out semicap subsystems, i.e. suppliers to the consensus long idea this year. See YTD numbers for UCTT, whose main customers include Lam and Applied Materials:

Surely we can get local press coverage for Metasurface on one of the hottest themes this year? They supply vacuum chamber parts to Applied Materials, a very important MNC in the Singapore economy. They also own 12.9% of Metaoptics, a listed company that is up 350% in the last six months.

You can find our write-up on the company here.

LITE -3.29%; COHR +4%; CIENA +1.6%

Four observations here:

The news that Apple’s Siri will be driven by Gemini will shine a light on “Google’s scaled delivery of TPU + OCS + optical networking and its broader cloud network infrastructure” and validate similar moves from other large enterprises (FundaAI)

Already seeing offshoots with Google x Walmart and Google x Shopify?