Singapore update #3

And the week ahead for paying subscribers

Dear subscribers,

This is the third quick-fire update on Singapore. TOC:

DBS’s 2040 projections for Singapore.

Hong Leong Asia.

Centurion.

Soilbuild.

A new industrial property development in Singapore.

The week ahead for paid subscribers:

I have been impressed by the OMS Technologies CEO and will try to follow up with someone who lived through the MBO.

Isoteam AGM - Can drones clean buildings? What do management and shareholders of this facilities management company think of the housing market and the companies that service it?

Tai Sin AGM - I am sending two people to this one. What does the shareholder base look like? Are people excited about the infrastructure buildout over the next five years? Who is benefitting from electrification and renewables in SEA? This has the potential to be a repeat of the XMH AGM.

Singapore Week of Innovation and Technology between 29 and 31 October - Speaking with Metasurface Technologies and more networking.

We are going to accelerate our DD of Monument Mining.

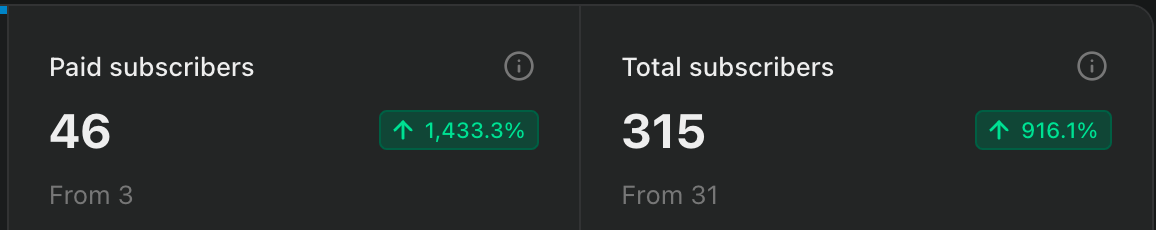

Close to 15% of you are paying subscribers, which I understand is above average.

Thank you for supporting the newsletter. I am aware that USD 200 a year is a lot to ask of the man on the street. Going paid has been an incredible motivation to find creative, persistent ways of researching companies and generating (hopefully quality) content. I might be a better steward of this tiny amount of money than my own PA.

For me, the conversion metric is more important than the total number of subscribers. What I would like to see is a high percentage of the free subscribers agreeing that the content is worth paying for. It is very gratifying.

The paid community provides very thoughtful questions and pushback, which not only helps me improve but sharpens the product for everyone else. A high quality (i.e. sharp and experienced) paid readership is a great flywheel.

Nonetheless, the number on the right has to grow and I apologise in advance for testing your patience with the occasional clickbait title. We will graduate out of it in due course.

If you’d like to join the 15%, the welcome offer runs till the end of the year. If USD 200 a year is a life-changing amount of money for you, please get in touch so I can deliver the Miranda warning about low cost index funds and perhaps offer you a discount.

DBS Singapore 2040 Report

Full report here.

SG nominal economy projected to double by 2040.

S$ projected to reach parity with US$ due to safe haven status and sustained current account surplus.

Equity market remains significantly underinvested relative to its money supply.

Liquidity driven by S$1.1 bn inflow YTD from US and EU, MAS S$5bn Equity Market Development programme, and domestic investors rotating out of T-bills with falling interest rates.

Key themes and sectors. See footnote for listed companies singled out by DBS.1

Financial Services

Trade and connectivity

Aging population

Energy and Climate Leadership

Real Estate

Digital Infra

Precision Engineering and Semiconductors

Cybersecurity

Biotechnology

Separately, the MAS has teased “value unlock” initiatives to be announced in November. These appear to include measures to encourage better IR. Looks like there will be sustained newsflow about the stock market leading into the year end.

Hong Leong Asia

Hong Leong Asia Ltd. is the trade and industry arm of the Singapore-based Hong Leong Group.

HLA’s largest business segment is Powertrain Solutions, operated through its majority-owned, NYSE-listed subsidiary, China Yuchai International Limited (Yuchai).

HLA is also a major, long-established integrated supplier of building materials in Southeast Asia (cement, precast concrete, etc).

HLA drew down ~20% this week before recovering slightly because of news that a Yuchai director and a former employee were detained by Chinese authorities.

I understand detention in China (which, to me, includes being prevented from leaving the country) is fairly common if you have any association whatsoever with someone under a serious investigation. By any association I mean including errand boys who managed calendars for an accused as their first job out of university 20 years ago.

A risk factor to keep in mind.

The detentions in this case apparently have something to do with the investigation of the former chairman of Yuchai. It is unclear what impact historic wrongdoing will have on the business going forward but if you think the risk is low then HLA might be worth a look here.

Centurion Corp

Centurion’s REIT closed above S$1.10 this week confirming that the market is happy with a yield around 6% or lower for foreign worker and student accommodation.

This brings Centurion’s NAV up to close to S$1.40 by my count. The joint chairman purchased another 300k shares at S$1.4x this week, after having purchased 300k two weeks ago.

Admittedly the road ahead is less favourable because foreign worker accommodation has to grow in jurisdictions less structurally advantageous than Singapore while xenophobia and unfriendly policies are thought to be driving foreign student numbers down in the UK and Australia.

I couldn’t disagree more with the latter, as my time with the business community in Thailand suggests that the affluent class in Asia and beyond would like nothing more than to enroll their children in the London School of Economics.

Soilbuild Construction

Soilbuild sold off on the announcement that it is considering spinning off its precast and prefabrication business. This adds to the list of other stocks that did not respond well to spin-offs short term including WHA Corporation, LHN Ltd and Centurion. I do not like this dynamic but will not fight the tape, i.e. sold immediately upon seeing the announcement.

Who knows where the bottom is, but if Centurion is anything to go by, it could be lower than we think.

Its worth relinking to the Floeburtus write up on the company again as we consider a re-entry point.

Industrial developer supergroup

We have some reservations about industrial property development in Singapore past 2028, chiefly because there is a lot of such property coming online and because of the abundance of cheaper space in neighbouring Johor, which appears to be making another attempt at a special economic zone.

That sentiment might not be shared by this consortium redeveloping a S$ 350m industrial site. The consortium includes the likes of LHN Ltd and the private vehicle of the Centurion chairs. On the other hand, perhaps the fact that there is a consortium suggests more cautious risk sharing, reflecting some uncertainty about the market going forward.

DBS singled out the following companies:

Financial Services: DBS, OCBC, UOB, SGX.

Trade and connectivity: Seatrium, SATS, SIA Engineering, ST Engineering, Nam Cheong, Marco Polo Marine, ASL Marine, Kim Heng, Beng Kuan, Penguin Intl, Samudera Shipping.

Silver Economy: Raffles Medical, IHH Healthcare, Parkway Life REIT. This is also driving all the nursing homes that Kwan Yong is building.

Energy and Climate Leadership: Sembcorp Industries and Keppel Ltd.

Real Estate: CapitaLand Investment, City Developments (CDL), Frasers Property, UOL Group.

Digital Infra: Keppel, ST Telemedia, Global Data Centres.

Precision Engineering and Semiconductors

Eagle Services Asia expanded GTF (geared turbofan) overhaul capacity by 66% with a 48,000 sqft robotics-enabled facility.

SAESL is investing USD180mn to boost Trent servicing by 40% and add 500 engineering jobs.

Collins Aerospace is building a USD250mn advanced manufacturing facility at Seletar (expected to complete in 2028).

RTX signed a 10-year memorandum of understanding with the Economic

Development Board (EDB) to expand MRO, manufacturing, and workforce training.

GlobalFoundries’ SGD500mn fabrication facility slated to be operational by 2027

UMC’s USD5bn fab expected to begin volume production in 2026.

Cybersecurity

ST Engineering is the largest player in cybersecurity.

Biotechnology

AstraZeneca started a SGD2bn antibody-drug conjugate (ADC) manufacturing facility in May 24

GSK has inaugurated a high‑potency manufacturing and testing facility in Nov 22.