Welcome - Start Here

By accessing or reading this post or any of our writing, you acknowledge and agree to our terms and conditions. This post was updated on 21 January 2026.

I run this newsletter full time, applying more than a decade of experience investigating a wide range of issues for Fortune 500 companies, including the 1MDB saga, AML failures at Nordic banks, corporate espionage, fraud, and more recently, accidents and global fleet issues for industrials.

Our core value proposition is that we will do what LLMs cannot - visit companies and speak with staff, partners, investors, and competitors. We cover companies in Singapore construction and the Singaporean, Chinese and Japanese data center value chain. Notable examples include:

I publish because I like industrials, scuttlebutt (which was how I distinguished myself professionally I think), and complementing mainstream financial journalism in APAC. Its just a happy coincidence that there happens to be a market for this by way of Substack.

In just over four months, we have 1,130 subscribers, of which 230 are paid subscribers including 48 on our Founding Member tier. Our philosophy is to listen to and serve our readers, aiming to gain one true fan a day.

In addition to the core investigative work, we have found it extremely productive to track Asian mainstream news, Twitter, Substack, WeChats and WhatsApps. The newsletter now also publishes a curated APAC roundup three times a week. We also have a daily thread in the subscriber chat that covers everything that does not make it into the APAC roundup.

The goal is to support investors with idea generation and maintenance due diligence, in an effort to beat the VanEck Semiconductor ETF, which is up 36% since this newsletter started on 2 September 2025.

Some reviews of our work:

Although this is not a stock picking service and we do not publish a model portfolio, we recognise that readers find it helpful to have a compendious update on the companies we own. We include that update below.

Chinese power equipment

CQME (2722.HK)

Conglomerate that owns stakes in JVs with Cummins and Hitachi.

This was our first post on the company. It has been covered in more detail by other writers:

Price targets crowdsourced from Asian Family Offices between HK$ 2.5 to HK$ 3.

We know of readers who have had great success trading in and out of this, making 20% each time. Our ACB is below HK$ 1.85 and we continue to hold this in anticipation of inclusion in the Shanghai-Hong Kong Stock Connect in March.

Wasion Holdings (3393.HK)

Thesis was summarised in our first post here.

We sold this recently just under HK$ 19 for a 30% return in three months.

We continue to visit Wasion’s factory in Johor every month for our paying subscribers.

Harbin Electric (1133.HK)

Harbin Electric is a company we mention frequently in our APAC roundups but do not currently own. The stock is up 126% since the newsletter started!

Semiconductor Capital Equipment

ACMR

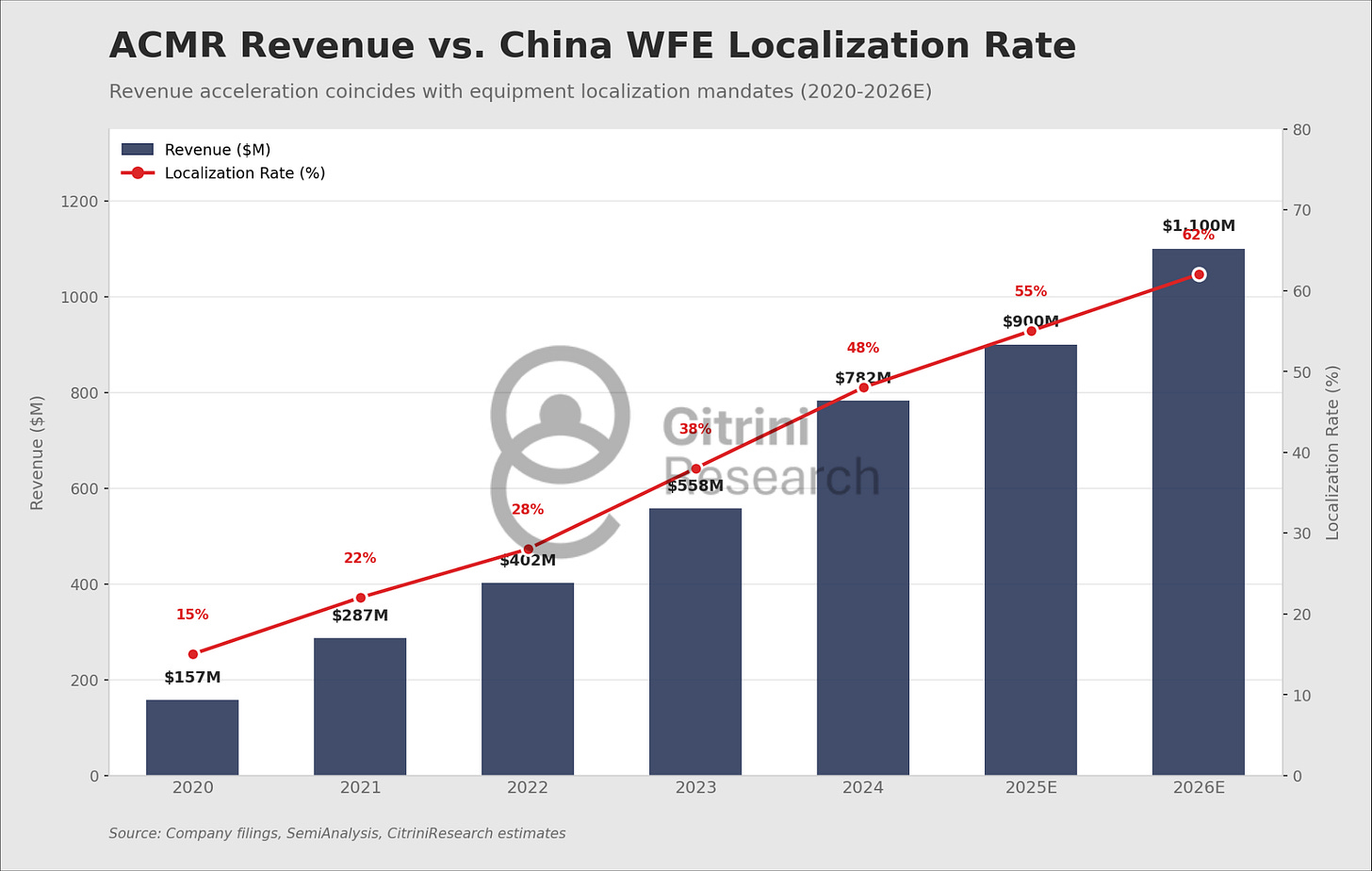

ACMR, domiciled in the U.S. but with its main operations in Shanghai, is the leading Chinese supplier of wafer cleaning tools. The main narrative taking hold online is that ACMR benefits from China’s semiconductor localisation drive.

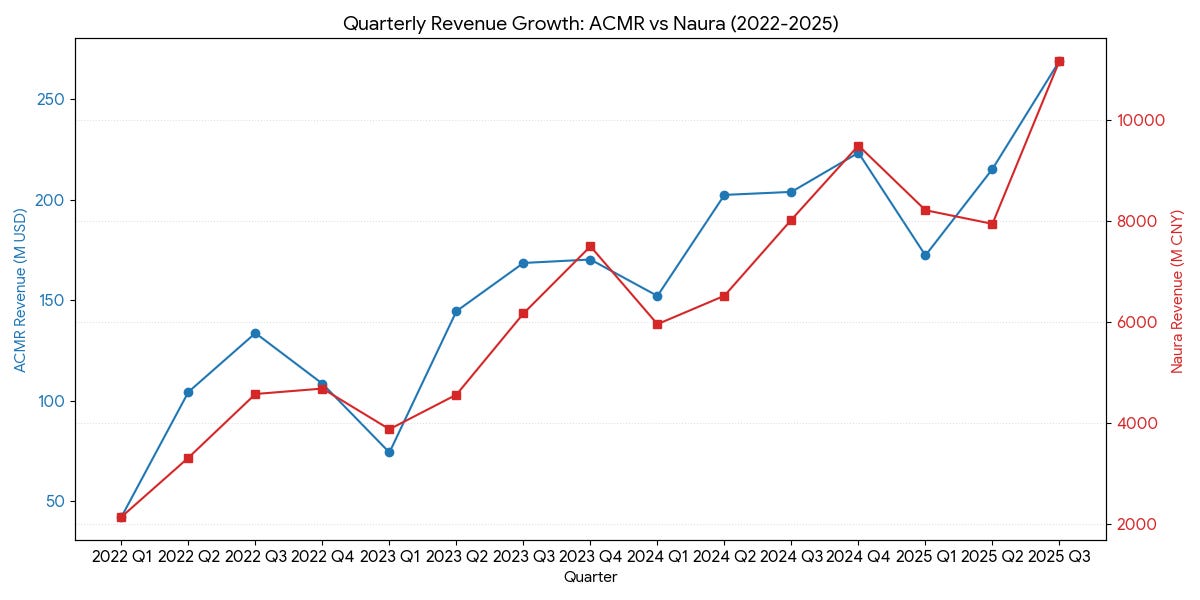

We previously posted these two charts to illustrate the point:

ACMR is up 29.8% YTD but one wonders how much higher the stock might go if any of these opportunities outside China take off: