Singapore update #4

Dear subscribers,

This is a roundup of everything we did last week.

Singapore International Energy Week

Singapore is setting aside 20ha of land on Jurong Island to host ~700MW of data centers. That is approx. 25 soccer fields or 35 American football fields.

We understand from DC Byte that Singapore has 1GW online, 500MW on the way, and now 700MW announced (representing 50% growth in DC capacity).

If the contracts are awarded to Tai Sin Electric $500.si (low voltage cables) that translates to approx. S$ 70m in revenue. The stock is 20% up from when we first wrote about it on 19 Sep.

If the structural works are awarded to CTR Holdings $1416.hk, that translates to around S$180m of revenue, assuming their share is 2% of construction cost of around S$9bn. Despite the big re-rate to to date, we believe the market still does not appropriately price CTR as a leading subcontractor in the data center and semicon market, with strong relationships with the likes of Exyte and Obayashi. More details on the paid subscriber chat.

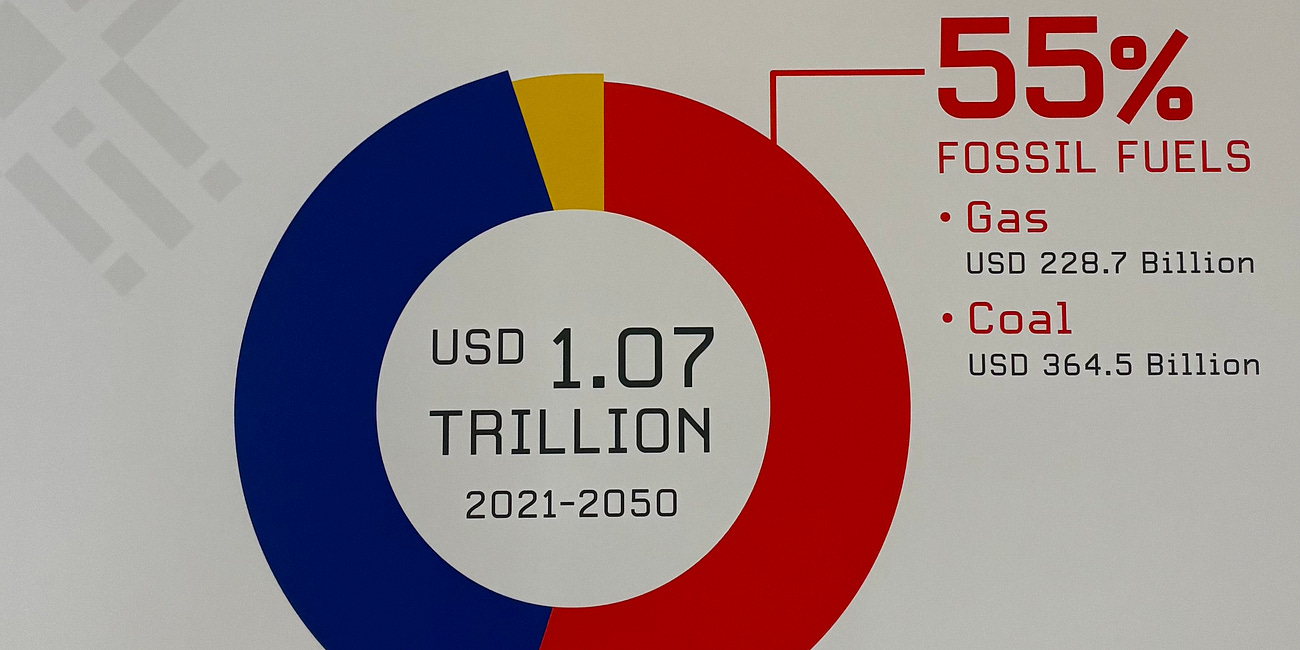

Consensus seems to be that massive investments in the ASEAN and Chinese grids are required. This is not news and is bullish for CQME $2722.hk and Wasion International $3393.hk.

For the latter, I also expect the market to respond more favourably to the one year trade truce, as it gives breathing room for Day One (Wasion’s main customer) to progress their series C and get their Johor data centers online. You can revisit our post here:

700% growth in the data center market and a cheaper valuation than peers

·In short, the thesis is that Wasion (3393.HK) is an increasingly discovered company that trades at a discount to peers that is unwarranted, in view of the explosive growth of its subsidiary that is supplying prefabricated data center solutions to Johor and beyond.

Scouting CTR’s projects

I thoroughly enjoyed pulling up to the sites of data centers and semicon plants to ask the crews if CTR Holdings is involved in a project. Migrant workers are a great bunch and it is a shame they are segregated so aggressively (the thesis underlying Centurion $ou8.si). I used to see them play cricket next to Little India and that space has gradually been reclaimed for flats and bus depots.

Having looked into CTR’s order book, we now have to look into the pipeline. Stay tuned.

CTR has quite a remarkable comeback story and is still trading below 2022 levels when it was a much less impressive company:

Micro-Mechanics AGM

Micro-Mechanics $5DD.si makes backend semiconductor testing tools in four Asian countries and frontend components for semiconductor manufacturing equipment in the United States, a capability acquired by way of an acquisition in 2008.

According to the CEO, the frontend components include the wafer handling robots and gas showerheads. These are critical components with low tolerance thresholds because they interact so directly with the wafer.

Q1 numbers were impacted because insignificant parts (“screws”) were held at customs, delaying deliveries. My first real world encounter with the impact of Donald’s policies.

The company was keen to tout its ostensible advantage in pursuing opportunities in advanced packaging because of their frontend and backend capabilities.

Someone name-dropped Japan Electronic Materials ($6855), the fourth or fifth most significant memory probe card supplier. It looked like an interesting idea but we are all out of bandwidth at the moment.

Tai Sin Electric AGM

$500.si - Published a paywalled note on this last week. I should probably ruminate on it a little more:

OMS Energy Technologies

OMSE 0.00%↑ Announced a new contract of undisclosed value with a Thai customer last week. They are drawing closer to customers, just like the CEO said they would.

A day after that, the CEO appeared on the local radio again. The company has hosted the recording here. Some points spoke to me:

Says he is focused on fundamentals and operations.

Does not want to say his job now includes “selling” the company to investors but he accepts that he needs to get out there to explain what they are doing. This is the second time he has described this as “painful learning”.

Core value essential for transforming a company is humility. Echoes of Lip Bu’s keynote for Intel?

Memory and Storage Supply Chain

In between all the above, I found some time to dig into some supply chain ideas to ride the HBM and HDD boom.

Seikoh Giken $6834 is my favourite idea for the optical market. It is probably worth writing a short primer on optical technology as most write-ups are very technical and inaccessible.

I am going to take abit of breather this week to let some of these ideas play out.

Looking ahead, for paid subscribers, we have Japanese HVAC and M&E ideas to continue the Japanese construction series.

We also have a little deck about Kwan Yong $9998 circulating IRL in Singapore, which might help with our reach to those who are less terminally online. We hope to encourage wider discovery of Singapore companies whose stories are not being told by management or the press.

Thank you again for reading and supporting the newsletter.

Thank you